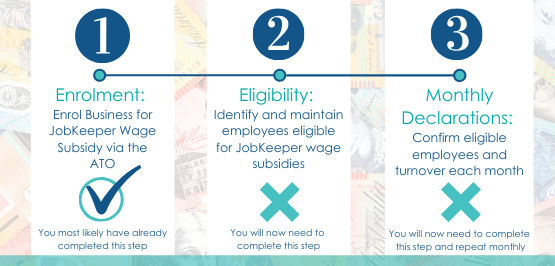

JobKeeper Payment: Important Next Steps

It is very important to keep up to date with the JobKeeper Payment next steps and upcoming key dates to ensure you don’t miss critical deadlines to receive payments. The ATO has identified 3 key steps in order to receive the JobKeeper payment. If you have already completed Step 1 and enrolled for JobKeeper, the important next steps you need to complete from this week in order […]

Read more

NSW Small Business COVID-19 Support Grant Applications Now Open

As outlined in our earlier Allan Hall mailout, in addition to the Federal Government’s stimulus measures to support businesses and individuals through the COVID-19 pandemic, Australia’s state and territory governments are also providing support measures for small businesses throughout the country. As the majority of our clients are based in NSW, we wanted to ensure […]

Read more

Applications Open: How to Apply for the JobKeeper Payment Scheme

Detailed information regarding the application for the JobKeeper Payment Scheme has now been made available by the ATO. If your business has been largely impact by the COVID-19 Pandemic, we encourage you to apply, should you meet eligibility criteria. The ATO has created specific JobKeeper guides to provide you with a high-level summary of the JobKeeper Payment Scheme to […]

Read more

Changes to Capital Gains Tax Main Residence Exemption for Non-tax Residents

In December 2019 the government passed laws that affect the main residence exemption for non-tax residents. If you are a non-resident of Australia, for tax purposes, you may need to consider selling your Australian family home before 30 June 2020*. *Note: This article was drafted before the Coronavirus pandemic which has had a significant impact […]

Read more

Boosting Cash Flow for Employers incentive

In response to the current economic climate, legislation has now been put in place by the Government to provide temporary cash flow assistance and incentives to support small to medium businesses that have been affected by the Coronavirus (COVID-19). We want you to be at the forefront of these assistance measures, to ensure that you receive the […]

Read more

Why Your Company Should Consider Using a Business Advisor

A good business advisor will build upon decades of experience across multiple industries, to deliver deep insights and knowledge of your business and the wider competitive landscape. They can best be described as a knowledgeable, accessible, motivated and forward-thinking professional, who will work closely with you to achieve both your business and personal goals – think of them as a high-end coach for your business! Whether it is […]

Read more

Should You Buy a Motor Vehicle in Your Business Name or Personal Name?

We are often asked this question many times by business clients who are purchasing a new motor vehicle. Unfortunately, there is no standard answer. It depends on many factors such as the cost of the car, its operating costs and its usage. Here are a few points to bear in mind when working out what […]

Read more

Allan Hall Business Advisors named Finalist in 2020 Client Choice Awards

Our team at Allan Hall Business Advisors are excited to announce that we have been named as a finalist in the 2020 Client Choice Awards for Best Accounting and Consulting Services Firm (<30m revenue). The Client Choice Awards recognise best practice in the professional services industry and are based on clients’ votes for professional services […]

Read more

Important Client Announcement: myGovID to replace AUSkey

Come April 1, 2020, you will no longer be able to use AUSkey to access the ATO’s Business Portal Will this change affect your business? If your business is currently utilising the ATO’s Business Portal, you will soon need to change the way in which you access this portal. Previously, AUSkey has been used to […]

Read more