COVID-19 impact on employees and employers

19/07/2021 | Allan HallThe government has imposed further restrictions from 18 July 2021 which will impact businesses in the Greater Sydney area, including the Central Coast, Blue Mountains, Wollongong and Shellharbour. Allan Hall HR are working hard to understand this fast-changing landscape and can help you to optimise the best solution for your industry and business.

Read more

NOW OPEN 2021 COVID-19 business grant

19/07/2021 | Allan HallThe eligibility for the 2021 COVID-19 business grant has been released and is expected to be open for registrations until 13 September. We summarise important points to consider before compiling an application.

Read more

2021 NSW COVID-19 business grant

15/07/2021 | Allan HallNSW COVID-19 business grants open 19 July 2021. If you’re a business, sole trader or not-for-profit organisation impacted by the current Greater Sydney COVID-19 restrictions, you may be able to apply for a grant of up to $15,000 from 19 July.

Read more

NSW COVID-19 support update

14/07/2021 | Allan HallNew COVID-19 support measures available from next week will provide eligible NSW businesses with a minimum of $1,500 and a maximum of $10,000 per week. Use the lead time to get your paperwork in order.

Read more

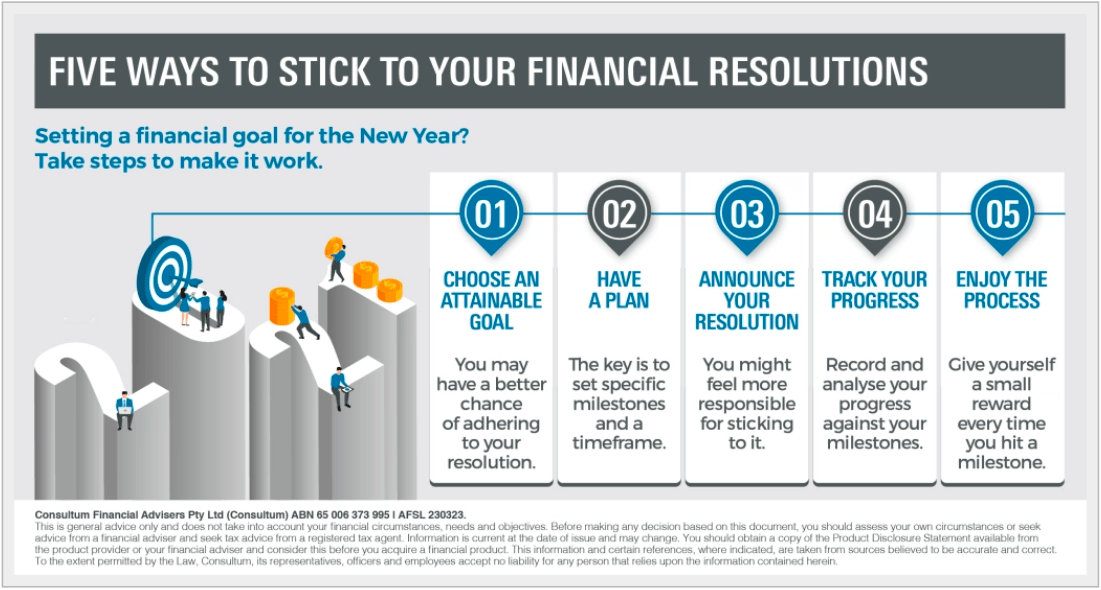

5 ways to stick to your financial resolutions

12/07/2021 | Allan HallIt’s that other time of year when we set new goals or dust off old ones. But how can we boost our chances of sticking to our financial resolution? Here are some practical tips.

Read more

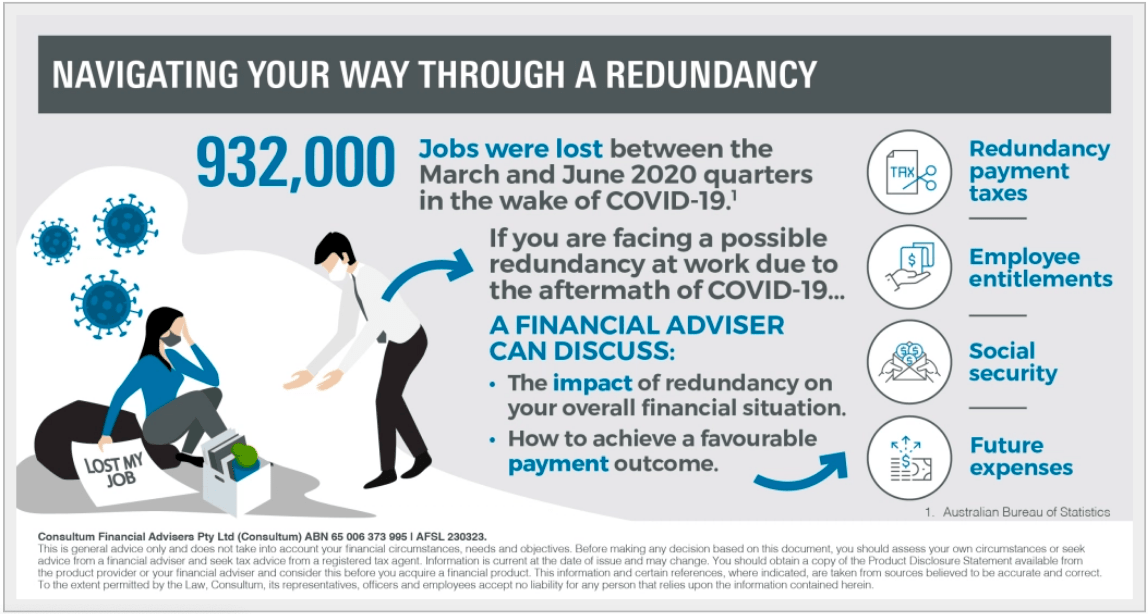

Navigating your way through a redundancy

05/07/2021 | Allan HallA redundancy may be beneficial if you’re ready to retire but stressful if you need to find a new job in a challenging economic environment. Some employers may be able to offer flexible payment arrangements on termination to facilitate a better tax outcome.

Read more