Using business money for private purposes

Use these 2 steps to make sure you're reporting any money or assets you take from your business for private purposes.

Read more

Business income: it’s not just cash

Cash, digital payments, stimulus vouchers and non-monetary payments or payments in kind could be considered as reportable business income.

Read more

Understanding Director Penalty Notices

Navigating the intricacies of DPNs can be challenging for directors, so engaging with a qualified tax advisor is crucial to gaining the necessary support and understanding.

Read more

Support for Australian small business

Two measures introduced into Parliament to ease pressure and boost resilience for small businesses.

Read more

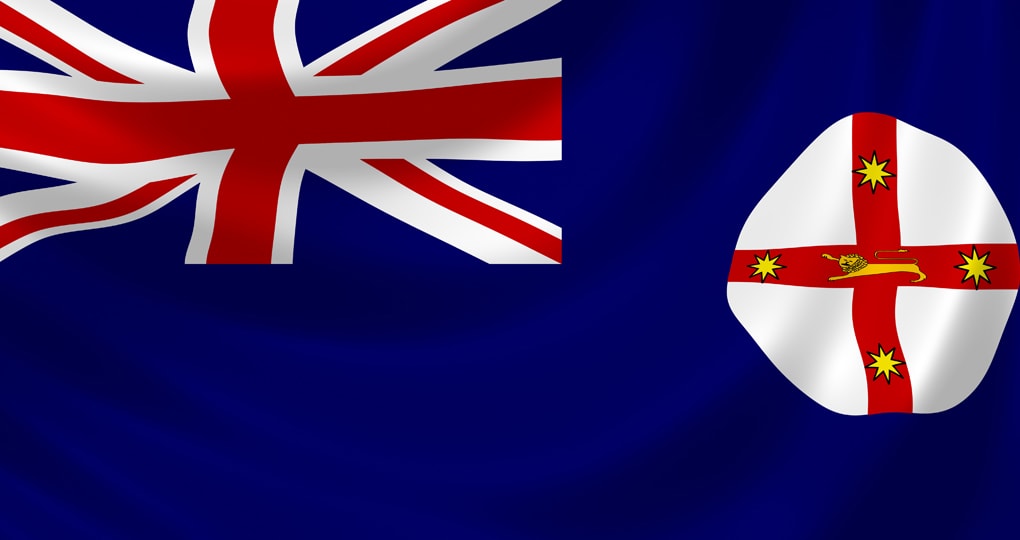

NSW State Budget 2023-24

The 2023-24 NSW State Budget has a strong focus on tightening tax compliance, as well as changes to a number of exemptions and duties.

Read more

Business debt on ATO’s watchlist

The ATO has unveiled their top 5 categories of business debt for follow up, signalling the end of the leniency extended during COVID-19.

Read more

NSW and Victoria enforce GP Payroll Tax

State revenue rulings clarify that medical centres will be liable for the levy under service fee arrangements.

Read more

ATO deadline reminder for contractor reporting

The ATO is reminding businesses required to lodge a Taxable payments annual report (TPAR) to do so by 28 August 2023.

Read more

Is your side hustle now a business?

If earning income from creating online content, social media influencing or other side hustles could mean you're in business, there are tax obligations that need to be met.

Read more