Allan Hall Financial Planning retirement

Our Financial Planning team bid a fond farewell to one of its senior advisors who retired after an illustrious career with Allan Hall.

Read more

Allan Hall named Financial Planning High Achievers

Allan Hall Financial Planning has been recognised as industry High Achievers in Auckland this month.

Read more

Teaching children healthy money habits

As a parent, you try to ensure your children have the skills to make smart financial decisions. But did you know that you could be sending them negative money messages without meaning to?

Read more

Consultum National Conference 2022 Award

Congratulations to Allan Hall Financial Planning Paraplanner, Laura, on being named Consultum Support Person of the Year 2022!

Read more

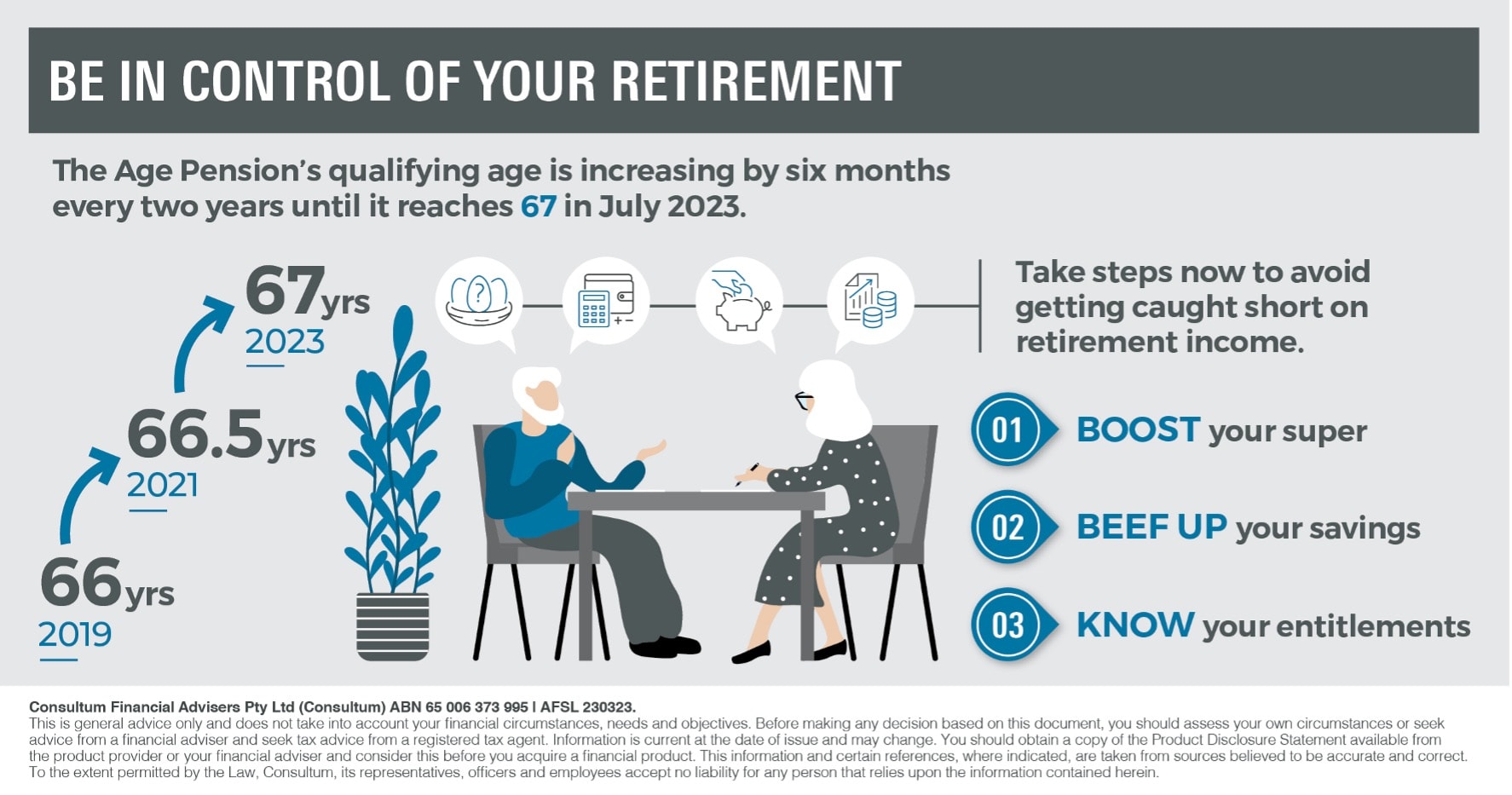

Be in control of your retirement

Approaching retirement? Take steps now to avoid getting caught short on retirement income and live the retirement lifestyle you want.

Read more

Why does insurance matter?

Having a plan in place if things do take an unexpected turn can mean that our health, lifestyle and family are better protected.

Read more

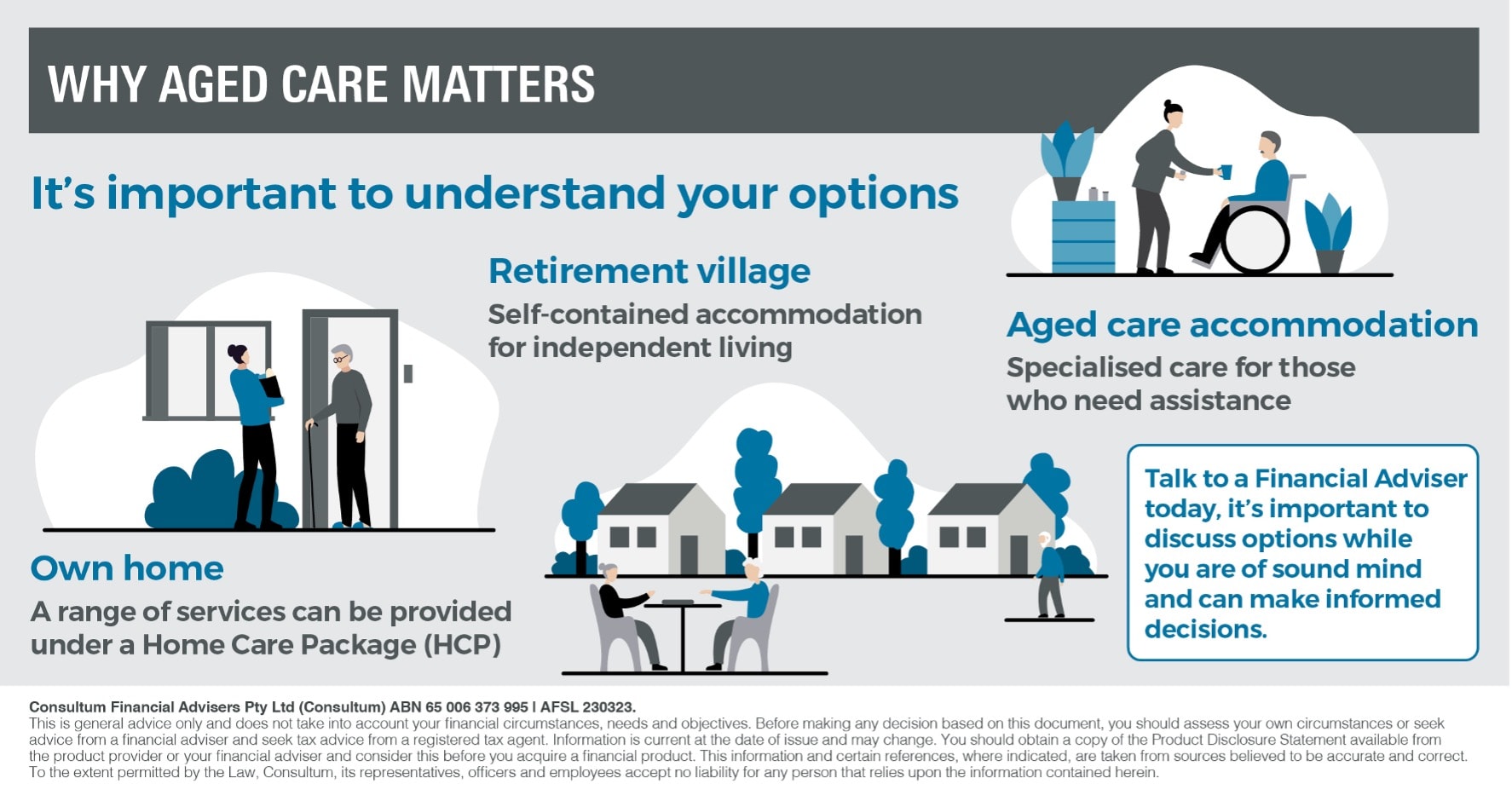

Why aged care matters

We highlight the importance of having options when it comes to aged care, and getting it right.

Read more

Financial advice helps you achieve more

We all have something we’d like to be doing more of. One thing we all want to make sure of is that we have a steady income stream to make the most of what we really want to do – now and in retirement.

Read more

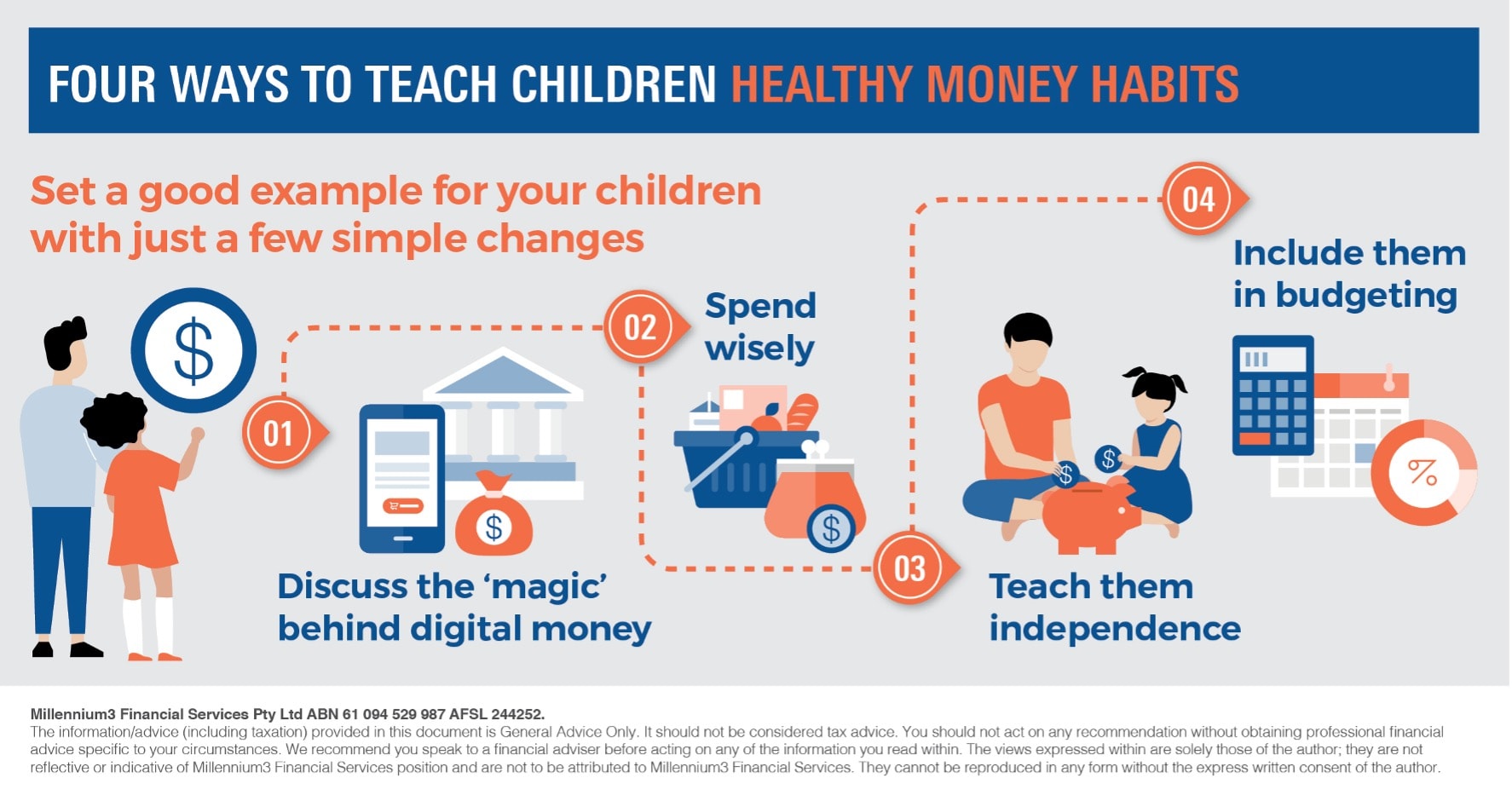

Four Ways to Teach Children Healthy Money Habits

As a parent, you try to ensure your children have the skills to make smart financial decisions. Here are four common ways you could teach your children healthy money habits.

Read more