Director penalty notices

If you're a director of a company with unmet debt obligations in respect of PAYG withholding, Super Guarantee Charge or GST, then the ATO will be contacting you.

Read more

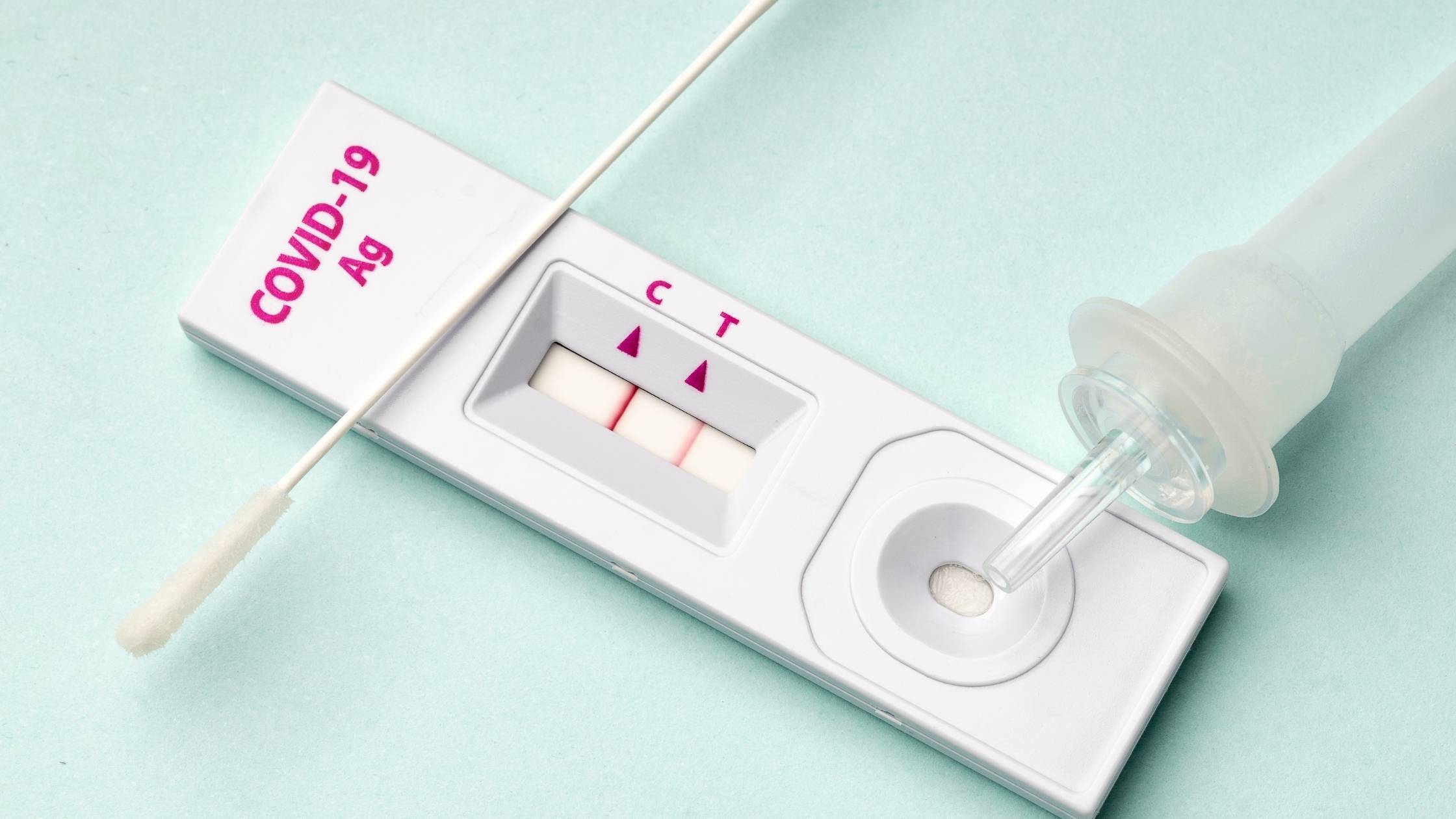

Tax rules and exemptions for COVID-19 testing

Though there are exemptions and deductions that can be granted when providing COVID-19 tests to employees, don't forget any FBT obligations.

Read more

Employee COVID-19 tests now tax deductible

From 1 July 2021, if you're an employee, sole trader or contractor and you pay for a COVID-19 test for a work-related purpose, you can claim a deduction.

Read more

Federal Budget 2022-2023

Allan Hall provides an overview of the changes outlined in the 2022-2023 Federal Budget handed down on Tuesday 29 March.

Read more

2022 FBT Motor Vehicle Declarations

The ATO requires all companies and trusts that have vehicles to keep odometer records of the total kilometres travelled during the year. Use our form to submit your reading on 31 March.

Read more

Claiming Family Tax Benefit and Child Care Subsidy

To enable us to lodge your returns by the 30 June deadline, we encourage you to send in your information as soon as possible and no later than 31 May 2022.

Read more

FBT Implications of Work Christmas Parties and Gifts

Every year, we are asked about the tax impact of various Christmas or holiday-related gestures. Here are our top issues.

Read more

Working From Home Temporary Shortcut Method Extended

Due to the continued extenuating circumstances of COVID-19 and lockdowns since 1 July, the 80 cents per hour temporary shortcut method to calculate working from home deductions has been extended to 30 June 2022.

Read more

Single Touch Payroll changes from 1 July

With EOFY fast approaching, reach out to us sooner rather than later to talk through the reporting option that’s right for you, and any steps you need to be aware of before 1 July.

Read more