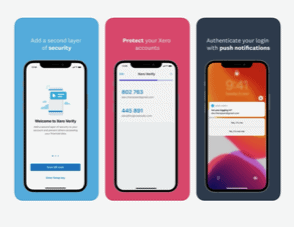

Introducing the new Xero Verify app

To give you fast, easy and secure access to your Xero account using MFA, Xero has created their own authenticator app called Xero Verify.

It’s built using the highest security standards to give you confidence that your account access is in safe hands.

Xero Verify is now available free of charge in the Apple and Google app stores. It only takes a few minutes to set up and sends a push notification to your phone when you log in, so you can just tap and go.

How we’ll help you prepare for MFA

While we encourage you to download Xero Verify and opt-in to MFA when it’s available, Xero will give plenty of notice before it becomes mandatory. As always, our team is here to support you, to make it as easy as possible for you to stay safe and secure.

Got a question on Multi-Factor Authentication on your Xero business account? Get in touch with our Bookkeeping team 02 9981 2300 for cloud bookkeeping assistance.

Allan Hall Business Advisers are Platinum Xero Partners.