From working for free to hiring the wrong staff

Xero research reveals 83 per cent of business owners admit to costly mistakes

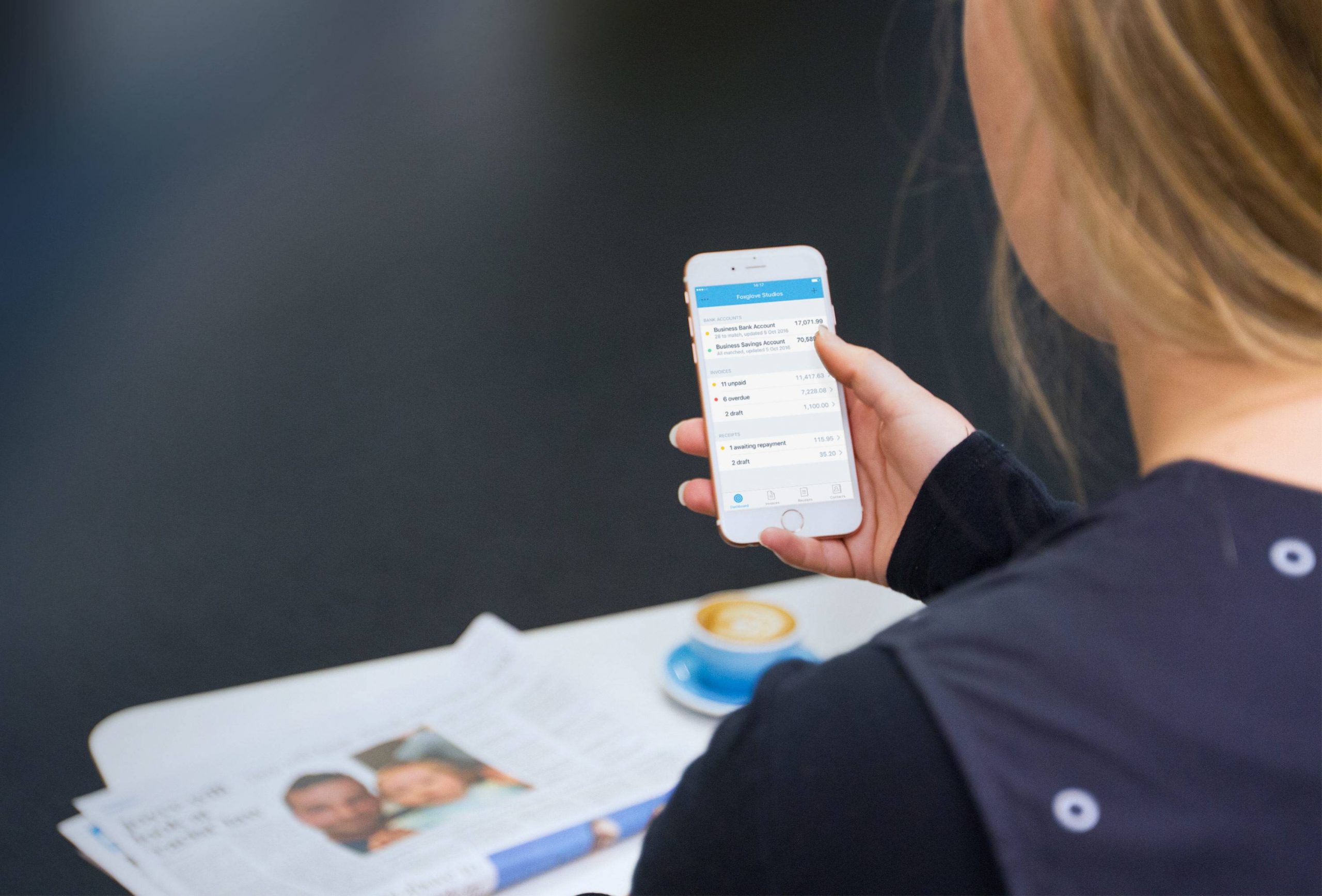

Xero, the small business accounting and bookkeeping platform, has released research revealing some of the most common learnings shared by Australian small business owners. The findings highlight that hiring the wrong or inexperienced staff and working for free or at low cost are considered the most costly business mistakes, impacting more than one in five (22%) small business owners.

The ‘Do Better Business’ research, which surveyed more than 1,000 Australian small business owners and leaders, not only sheds light on the challenges faced, but offers invaluable insights for businesses embarking on a new financial year, and provides helpful learnings for aspiring entrepreneurs.

“We know running a small business can be incredibly rewarding, enabling people to pursue their passions or achieve greater flexibility. But, as our research has highlighted, it also comes with its unique set of challenges, which have only been exacerbated by a turbulent economic climate,” said Will Buckley, Xero Australia Country Manager.

“As the new financial year commences, it’s a timely opportunity for business owners to reflect on the year that was and embrace key learnings that will pave the way for future success.”

Taking risks and learning from setbacks

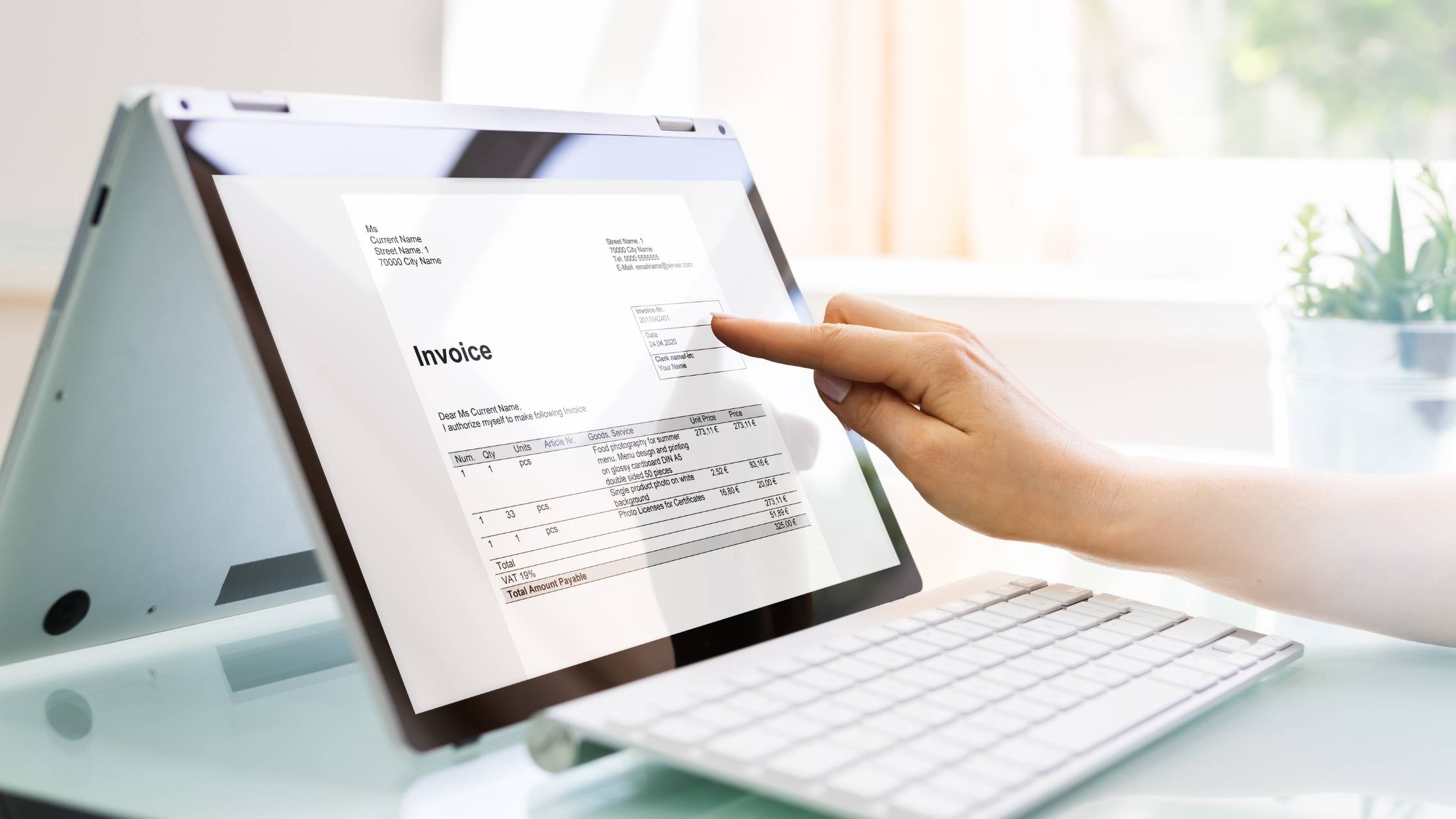

Owning a small business is a constant learning process, with the majority (83%) of those surveyed admitting to making costly mistakes over the course of running their business. In addition to hiring challenges and working for free, working with the wrong partners, suppliers and investors (18%) and working with family and friends (12%) were other blunders. Additionally, nearly one-fifth (19%) reported spending every dollar of their personal savings in the early years of running their business.

Among the biggest learnings was a need to implement strong financial management practices, with nearly three-quarters (73%) of those surveyed rating this as the top three priorities they believed small businesses starting up should focus on. This was followed by building a strong network of industry contacts (63%), working with an accountant or bookkeeper (46%), and asking for help when struggling (46%).

Greater flexibility driving business ownership

There are many reasons driving Australians to business ownership, but the survey revealed a desire to be their own boss as the number one reason for 64 per cent. This was followed by seeking greater flexibility (61%) and wanting to pursue a passion or dream (41%). Nearly three-quarters (71%) of small business owners, however, admit to delaying starting their own business, with financial concerns being the number one reason holding them back (35%), followed by a fear of failure (21%). Despite this, 65 per cent of business owners surveyed by Xero say there’s never a perfect time to start a business, but they wish they’d done it sooner.

Small business ownership is also not without its sacrifices, with one in five (20%) small business owners from the survey reporting they missed a significant life moment like the birth of their child, a wedding or a birthday in the early years of running their business. The majority of those surveyed (86%) also wish they could prioritise their personal boundaries more while running their business, especially around their physical and mental health (43%) and spending time with their family, friends or partner (40%).

“Fostering an environment where Australians feel confident to pursue business ownership and are supported throughout their entrepreneurial journey is essential to ensuring a prosperous small business community and a resilient economy. We hope that by understanding some of the challenges facing small businesses, together with industry and governments, we can provide the right tools and technology to ensure businesses have the best possible chance to thrive this financial year and into the future,” said Buckley.

The generational divide and young small business owners holding back

The survey revealed it’s tougher for younger people to get into business ownership, with Gen Z reporting they were more likely to face negativity and discouragement from friends, family and associates about starting their own business venture (77%) compared to Baby Boomers (60%).

The fear of failure was also more common amongst young business owners and entrepreneurs with 29 per cent of Millennials saying they delayed starting their business because they didn’t want to fail, compared to just 12 per cent of Baby Boomers. Despite this, the flexibility of being a business owner was a central reason for 68 per cent of Gen X business owners, with 60 per cent saying they are now achieving this goal.

Considering Xero for your business? Alliott NZ’s Xero Certified Advisors in Auckland are here to answer any questions or to help your business upgrade to or optimise using Xero.

About Xero’s research: The research was conducted by YouGov of 1,022 owners and key decision-makers of businesses with fewer than 50 employees in Australia. Fieldwork was undertaken between 22-30 June 2023.

At Allan Hall, we have extensive experience using a wide variety of accounting software packages and can provide advice on which software is right for you.

CONTACT ALLAN HALL BUSINESS ADVISORS