What you need to know

There are legal, financial, and other changes your business will have to be across very soon. Not sure what they are or what to do? Don’t worry, we have you covered.

It’s been a big year for changes in areas like people management, pay and tax. Here’s a rundown of some key changes that will come into effect 1 July and what they mean for your business and your employees.

1. SUPER GUARANTEE INCREASES

If you haven’t already, then it’s time to get your payroll systems sorted as the superannuation guarantee increases to 11% from 1 July.

Also, make sure you’re across the gradual increases, which will see the super guarantee reach 12% by July 2025.

To work out how this will impact employees’ pay, have a look at whether their contract states their salary is inclusive of superannuation or not.

2. WAGES GO UP

Employees should also be aware that from 1 July, wage increases will come into effect following a ruling from the Fair Work Commission.

For employees who aren’t covered by an award, the minimum wage will go up from 1 July to $882.80 per week, or $23.23 per hour, and will apply from the first full pay period starting on or after 1 July 2023.

For employees covered by an award, minimum award wages will increase by 5.75%, also applying to the first full pay period starting on or after 1 July 2023.

3. FAIR WORK COMMISSION CHANGES

From 1 July 2023, the application fee will increase to $83.30. The fee applies to dismissal, general protections, bullying, and sexual harassment at work applications made under sections 365, 372, 394, 773, and 789FC of the Fair Work Act 2009.

There is no fee to make an application to deal with a sexual harassment dispute under section 527F of the Fair Work Act.

Also effective from 1 July, the high-income threshold in unfair dismissal cases will increase to $167,500 and the compensation limit will be $83,750 for dismissals occurring on or after 1 July 2023.

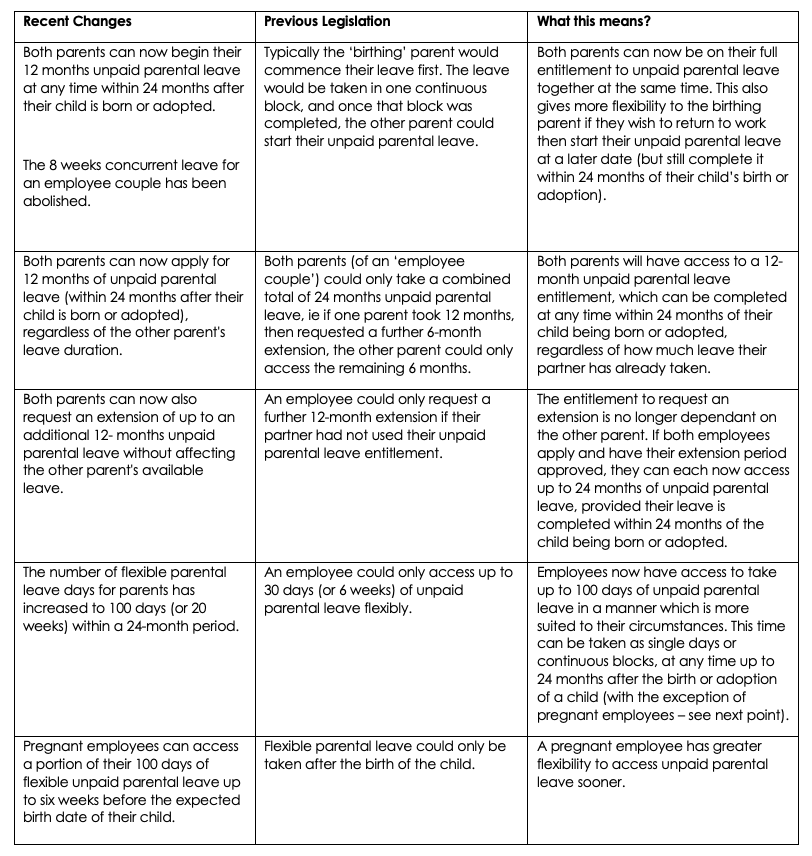

4. PAID PARENTAL LEAVE CHANGES

From 1 July, amendments to the Paid Parental Leave Scheme will come into effect.

Notably, the Dad and Partner Pay (DAPP) scheme, which currently provides up to two weeks of paid leave, will now be combined with the 18-week paid parental leave scheme. This means eligible parent couples or single parents can share their 20 weeks of leave – aimed at greater gender equity in parental caring responsibilities.

There are other changes, too, such as the whole 20 weeks of leave of instalments can be received flexibly in multiple blocks within 24 months of the child’s birth or adoption date, removing the previous requirement of 12 weeks in one continuous period.

Also, note that employees now have greater rights to request an additional 12 months of leave (24 in total) – and employers need to show reasonable business grounds on which to refuse.

5. CHILDCARE SUBSIDIES

For those who employ parents with young children, it’s worth noting that childcare rebates will change from 1 July. They should result in any employees with a family income of less than $530,000 getting a higher level of subsidy for the cost of childcare.

For example, families earning up to $80,000 will get an increased maximum Child Care Subsidy (CCS) amount, from 85% to 90%. If they earn over $80,000, they may get a subsidy starting from 90%, but it will go down by 1% for each $5,000 of income the family earns.

While these changes are applied automatically, it is worth being aware that they are coming.

6. DOMESTIC VIOLENCE LEAVE INTRODUCED

From 1 February, employers with 15 or more employees were required to provide their employees with 10 days of paid family and domestic violence leave (FDVL) per year.

For smaller employers who employ less than 15 employees, this entitlement will operate from 1 August 2023.

Paid family and domestic violence leave is quite a sensitive topic, and there need to be procedures in place – on everything from how the HR or manager handles requests to the privacy issues around how it gets recorded on a pay slip.

7. PENSION AGE AND ELIGIBILITY INCREASES

For those businesses employing older Australians, it’s worth noting that from 1 July, the pension age will be raised to 67 for those born on or after 1 January 1957.

Not only that but asset and income eligibility tests will also be revamped, which means singles can earn $204 a fortnight and couples $360 a fortnight, before losing their full pension.

8. ENERGY BILL RELIEF ON ITS WAY

With soaring power bills contributing significantly to business operating costs, $650 in bill relief is on its way from July.

The total amount of bill relief will vary by state. To be eligible, your business must be on a separately metered business tariff with your electricity retailer – so if you run a business from home, you probably won’t qualify.

CONTACT ALLAN HALL BUSINESS ADVISORS