Are you approaching retirement?

Then chances are the funding of your lifestyle in retirement may be on your mind.

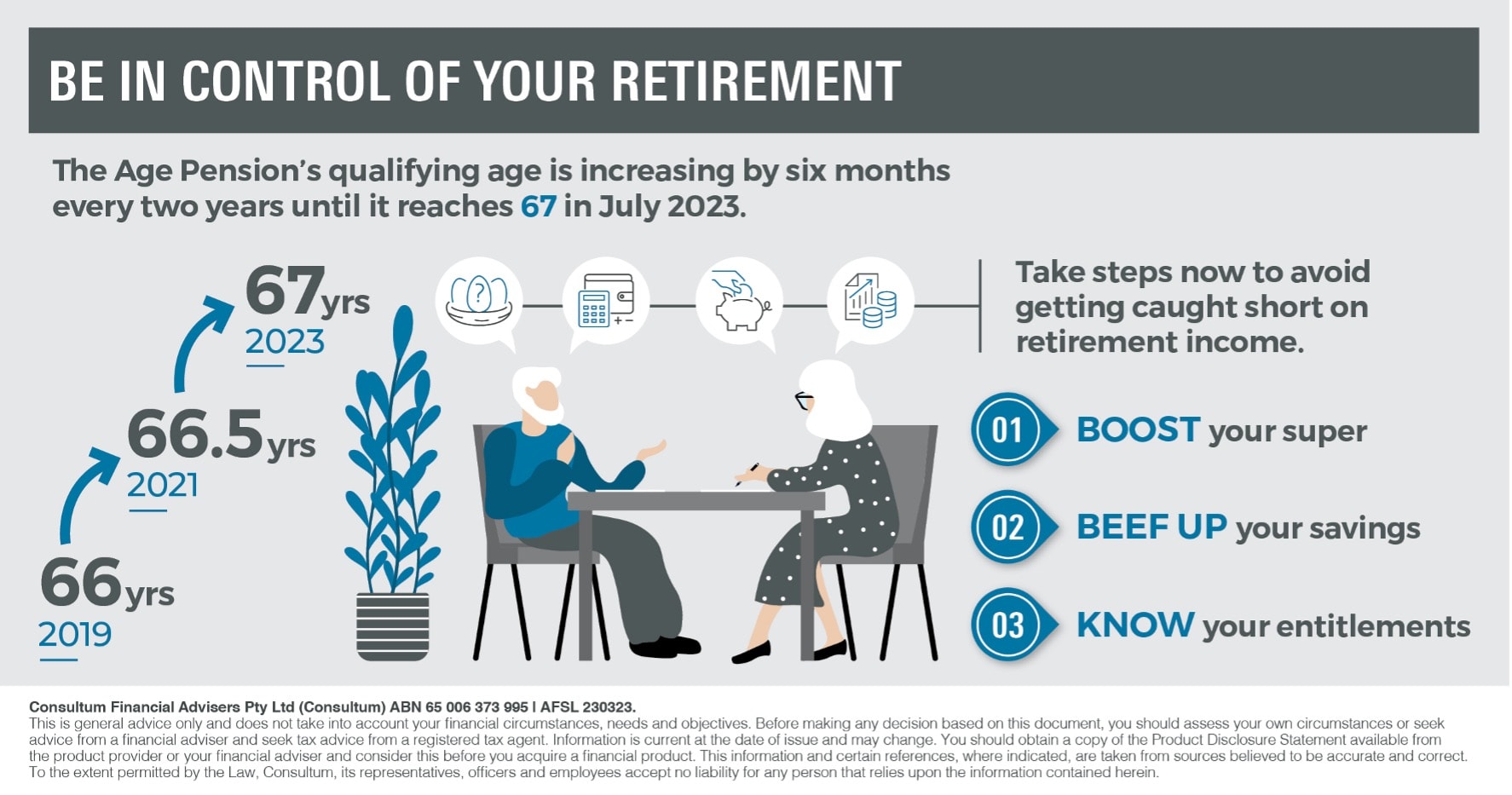

Take steps now to avoid getting caught short on retirement income and live the retirement lifestyle you want.

The qualifying age is increasing by six months every two years until it reaches 67 in July 2023. The Age Pension age increased to 66 and a half on 1 July 2021.

If for example, you are planning to retire at 60 you will need to wait until you’re 67 before you can apply for the Age Pension. You’ll have to rely on your own savings and super in the interim, making it crucial to ensure you have enough money put away for later years. But the good news is that there’s still time to grow your retirement savings.

Boost your super

Contributing more to your super can be a reliable route to bolstering your retirement fund. By making extra contributions through salary sacrifice, you can grow your super and at the same time reduce the amount of income tax you pay. The government will tax your salary sacrificed contributions, within the allowable concessional contribution cap, at 15 per cent, which may be much lower than your marginal tax rate.

Making non-concessional or after-tax super contributions is another option. Generally, you can contribute up to $110,000 each financial year if your total super balance is less than $1.7 million at 30 June of the last financial year. To understand how these contributions work, it’s wise to get professional advice.

Beef up your savings

Your personal savings outside of super can supplement your super payments in retirement. But are they growing enough now to provide you with some level of income when you retire?

To build up your savings, you may have to invest part of it and make sure it’s growing faster than the rate of inflation over the long term. You should seek professional advice to see what investments are appropriate for you.

Know your entitlements

Besides the Age Pension, you may be eligible for other government benefits and concessions. For example, you may be eligible for a concession card such as the Pensioner Concession Card (if you are receiving the Age Pension), Commonwealth Seniors Health Card or the state-based Seniors Card. Concession cards like these may entitle you to discounts on some commercial and public services. Concessions that allow you to buy prescription medicine at a discount may also be available.

But keep in mind that these benefits have strict eligibility rules. There’s also no guarantee that these entitlements will still be available by the time you retire. So, take charge of your retirement.

Working with your financial adviser, you can develop a strategy that helps ensure you’ll be well provided for regardless of changes to pension policies.

CONTACT ALLAN HALL FINANCIAL PLANNING

General Advice Warning

The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.

Mark O’Connell, Robin Bell and Allan Hall Financial Planning Pty Ltd are Authorised Representatives of Consultum Financial Advisers Pty Ltd ABN 65 006 373 995 AFSL 230323.