Mark O’Connell Farewelled after a Decade of Outstanding Service

As the curtains drew to a close on 31 December 2023, the Allan Hall Financial Planning team bid a fond farewell to one of its senior advisors, Mark O’Connell, who retired after an illustrious 10-year career with the company.

Mark’s invaluable contribution to the financial planning team has left an indelible mark on Allan Hall, and his retirement is celebrated as a well-deserved culmination of a successful career.

During his time, Mark played a pivotal role in shaping the success and growth of Allan Hall Financial Planning. His dedication and expertise were instrumental in establishing the firm as a trusted name in financial advisory services and the team is grateful for the wealth of knowledge and experience he brought to the table.

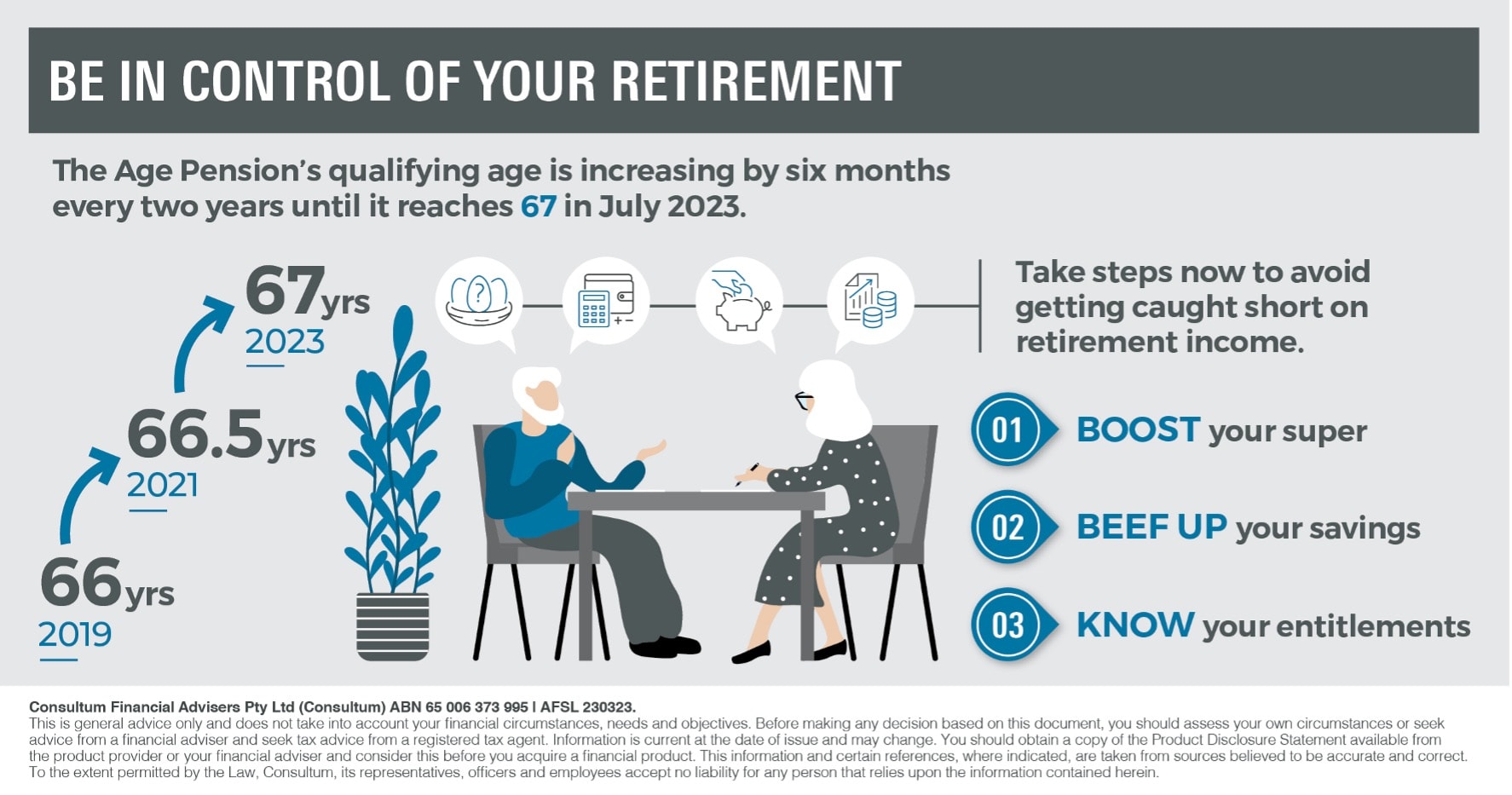

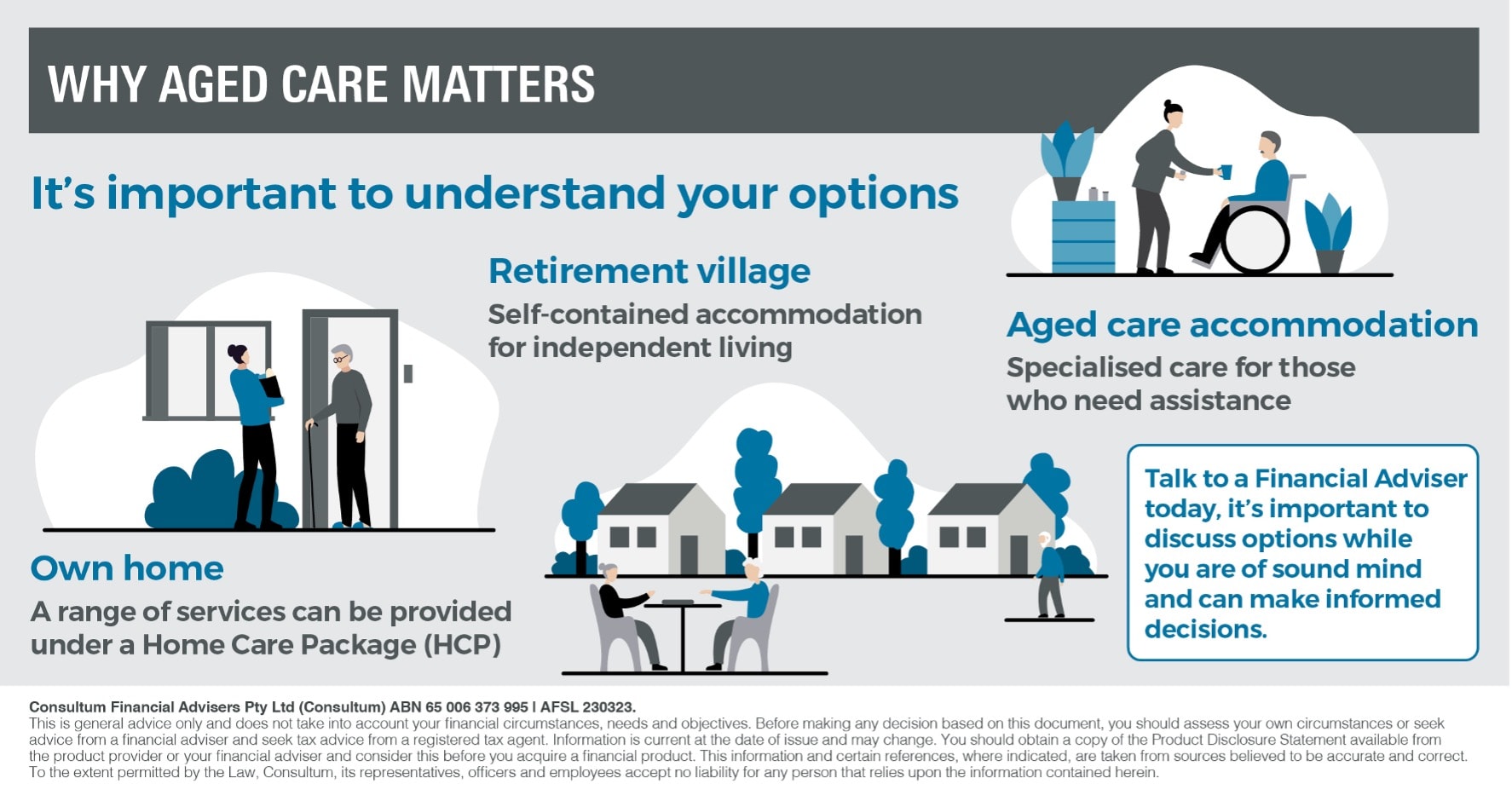

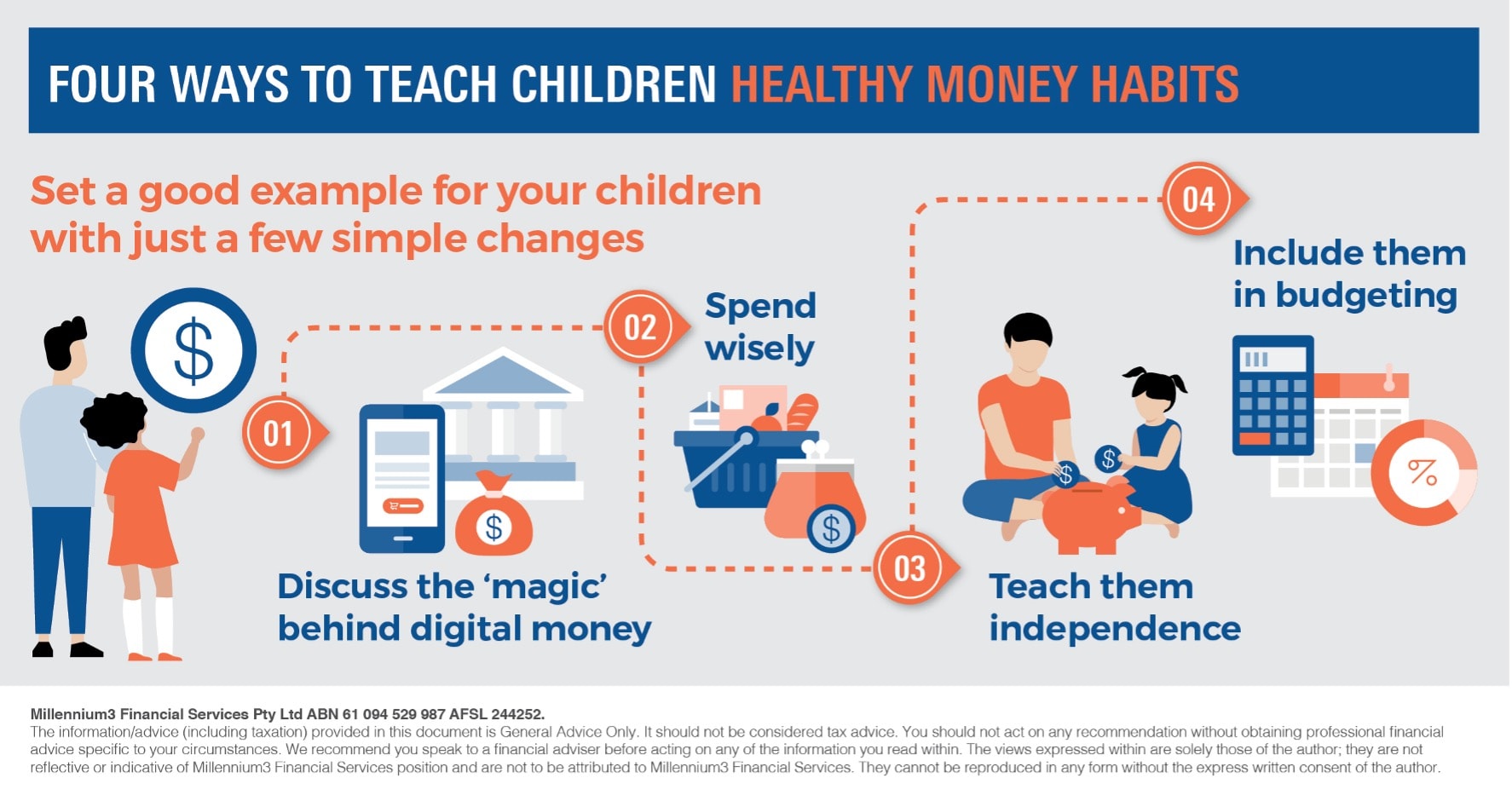

The Allan Hall Financial Planning team, now under the capable leadership of Robin Bell, consists of three advisers and three support staff, all of whom boast extensive knowledge and experience in the financial services industry. The team prides itself on its commitment to providing comprehensive financial planning advice, covering areas such as wealth accumulation, retirement planning, wealth protection, superannuation, investments, and personal and business insurance.

Over the last 12 months, Mark’s valued clients have undergone a seamless transition to two highly qualified advisers within the team — Martin Cimino and Angelo Adam. Martin, who joined the team in February 2023, brings a wealth of experience from a successful stint as a partner/director of a financial planning company, where he also served as a Senior Private Wealth Adviser since 2010. Angelo, an adviser since 2019, has been instrumental in assisting clients with their personal insurance needs.

Allan Hall Financial Planning takes pride in its diverse and loyal client base. Situated in the ‘Lifestyle Working’ building in the heart of Sydney’s Northern Beaches, the office provides a modern and inviting environment for both clients and employees. The open-air meeting spaces and light-filled offices foster innovation and vitality in the workplace, making it an ideal setting for client interactions.

As an integral part of Allan Hall Business Advisors, the financial planning team collaborates closely with accountants, tax advisors and SMSF specialists. Acting as a ‘financial coach,’ the team ensures that clients’ financial and lifestyle goals are thoroughly understood and met across various areas. This holistic approach sets Allan Hall Financial Planning apart, making it a trusted partner in guiding clients through their financial journey.

Mark O’Connell’s retirement may mark the end of a chapter, but the legacy of his contribution endures as Allan Hall Financial Planning continues its commitment to excellence and client satisfaction. The team looks forward to the future, building upon the foundation laid by Mark and embracing new opportunities for growth and success.