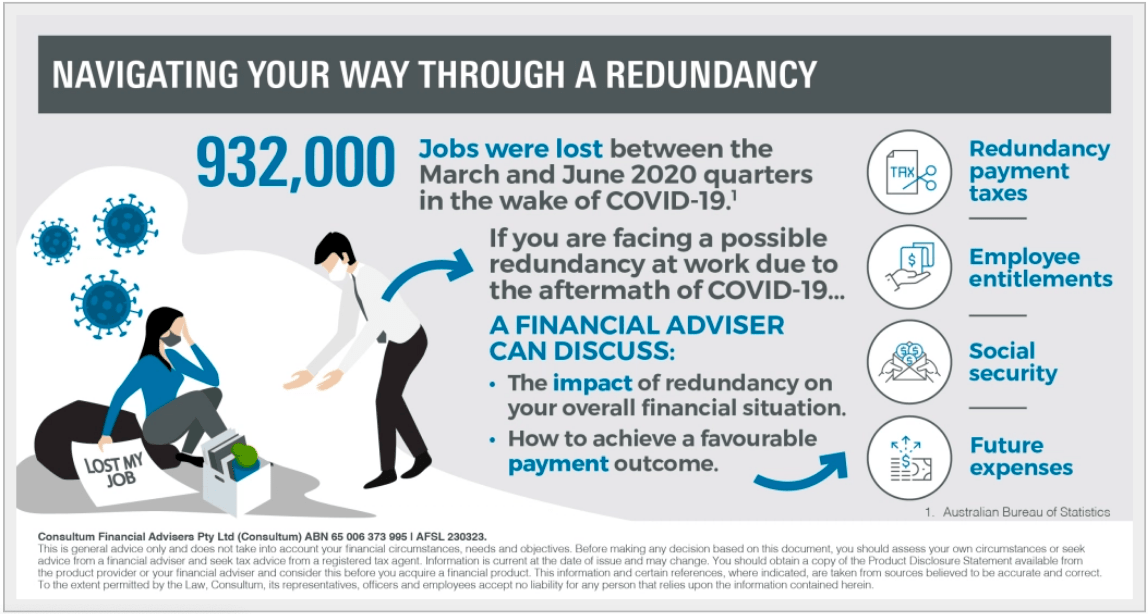

The ABS announced a record 932,000 jobs lost between the March and June 2020 quarters in the wake of COVID-19

While the Government extended temporary economic assistance for most businesses until March 2021, it has gradually been phased back which may result in many businesses downsizing, winding up or becoming bankrupt.

This means it’s possible that more jobs may be lost in the coming months.

If you are facing a possible redundancy at work due to the aftermath of COVID-19, or a company restructure, this is considered a significant life event that may impact your career, family, mental health and financial wellbeing. For those who are ready to retire, termination payments are likely to be a welcome windfall, but for those who don’t have retirement on the near horizon, you may find redundancy stressful, as it tends to happen during an economic downturn when it may be harder to find a new job.

The immediate issue to consider is whether you have enough money to tide things over until the next job comes along. If you are working with a Financial Adviser, then they will have a good idea of what your current financial position looks like, and how long you can manage without a job. They can also advise on different options to consider when it comes to a redundancy payout.

Your Financial Adviser can discuss:

- How will redundancy payments be taxed?

- What other employee entitlements will be lost?

- Will lump sum payments impact on entitlements to social security and family assistance?

- How will payments be used?

This is a great opportunity to make a real difference to your situation during a challenging time, and, if you are the employer, you may be able to support your employees to achieve a better outcome.

Genuine redundancy payment (GRP)

Payments on termination due to redundancy attract more generous tax concessions than if the employee resigns. If you are offered and accept a redundancy, it is worth knowing about the tax concessions and the conditions that must be met to be eligible.

A GRP must satisfy the following conditions:

- The employee is dismissed because the employee’s position/role no longer exists

- There is no arrangement between the employer (or another entity such as a company associated with the employer) and employee to rehire the employee after dismissal

- Where the relationship between the employer and employee is non-arm’s length, the payment cannot be greater than the amount that would be reasonably expected if the relationship was at arm’s length

- The dismissal occurs at the earlier of the following:

- before the employee attains Age Pension age, or

- before the employee attains the age, or completes a period of employment, when employment would have terminated.

If these conditions are not met, the employee is ineligible for the tax concessions that apply to GRPs. For example, where redundancy occurs on or after Age Pension age, the employee is not eligible for a tax-free GRP.

Payments on termination

Payments that may be received by an employee who is made redundant include:

- salary and wages, overtime, bonuses and allowances

- unused annual leave and long service leave

- severance payments

- a gratuity or ‘golden handshake’

- genuine redundancy or early retirement scheme payments

- non-genuine redundancy payments (eg redundancy occurs after employee reaches Age Pension age)

- payments in lieu of notice

- unused sick leave

- unused rostered days off.

Taxation of payments

Payments on termination are categorised to determine how they are taxed. If you are offered a redundancy, you can plan ahead by asking your employer for an estimate of the payments you will receive, including withholding tax amounts. Your employer can provide you with an income statement at termination or you can obtain this from the Australian Taxation Office (ATO).

Payments eligible for concessional tax treatment attract tax offsets so that the tax paid does not exceed the concessional tax rate. Tax withheld by your employer reduces the final tax payable and if too much tax was withheld the excess is refunded to you.

Your Financial Adviser can help you identify and work out:

- Payments for earned income

- Tax on unused annual or long service leave

- non-excluded employment termination payment (ETP), the tax-free genuine redundancy payment (GRP) and the excluded ETP.

Other considerations

As well as working out any payments, your Financial Adviser can discuss other financial and personal considerations, including:

- How ongoing expenses can be met and for how long

- Whether you intend to retire and if not, how long it may take to find another job

- Other financial resources available to you

- Eligibility for social security payments and/or Family Tax Benefits

- Whether your employer has the flexibility to ‘time’ the redundancy and termination payments to assist with a better tax outcome

- Whether deferring taxable income (for example deferring the sale of investments with capital gains implications) will have a favourable outcome

- Your capacity to make personal deductible super contributions

- What you would like to do if you do decide to retire, and what your retirement lifestyle will look like given your financial situation

- If you decide to return to the workforce, whether your next job can pay a similar salary or if you take a pay cut in the current economic environment.

Redundancy may be beneficial if you’re ready to retire but stressful if you need to find a new job in a challenging economic environment. Some employers may be able to offer flexible payment arrangements on termination to facilitate a better tax outcome.

A Financial Adviser will discuss both the impact of redundancy on your overall financial situation and how to achieve a favourable payment outcome.

CONTACT US

General Advice Warning

The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.

Mark O’Connell, Robin Bell and Allan Hall Financial Planning Pty Ltd are Authorised Representatives of Consultum Financial Advisers Pty Ltd ABN 65 006 373 995 AFSL 230323.