Understanding the Implications of the Proposed $3M Super Tax

As the proposed tax on superannuation balances exceeding $3 million draws nearer, individuals potentially affected by this measure are urged to assess its implications thoroughly.

While not yet enacted into law, the Division 296 tax warrants careful consideration in investment strategies, especially concerning end-of-financial-year contributions into super.

- For those affected, a strategic reassessment may be necessary, considering whether high-growth assets should be held within superannuation, given the potential tax implications

- Individuals may need to reconsider investment vehicles, balancing tax effectiveness with asset protection

- Estate planning and succession plans for Self-Managed Superannuation Funds (SMSFs) will require revisitation post-implementation of Division 296 to mitigate unnecessary tax burdens on beneficiaries.

Division 296 legislation proposes an additional 15% tax on investment earnings of super accounts with total super balances (TSB) exceeding $3 million at the end of the financial year.

It’s important to note that this extra tax applies only to the portion exceeding $3 million.

Key aspects of the legislation include the concept of Adjusted Total Super Balance (ATSB), which determines the $3 million threshold. The ATSB calculation by the Australian Taxation Office (ATO) considers the market value of assets regardless of realisation, significantly affecting super funds holding property or speculative assets. Additionally, the legislation introduces a new formula for calculating ATSB for Division 296 purposes.

Under Division 296, deemed earnings exceeding the $3 million threshold will be apportioned and taxed accordingly. Negative earnings in such instances may be carried forward to offset future liabilities.

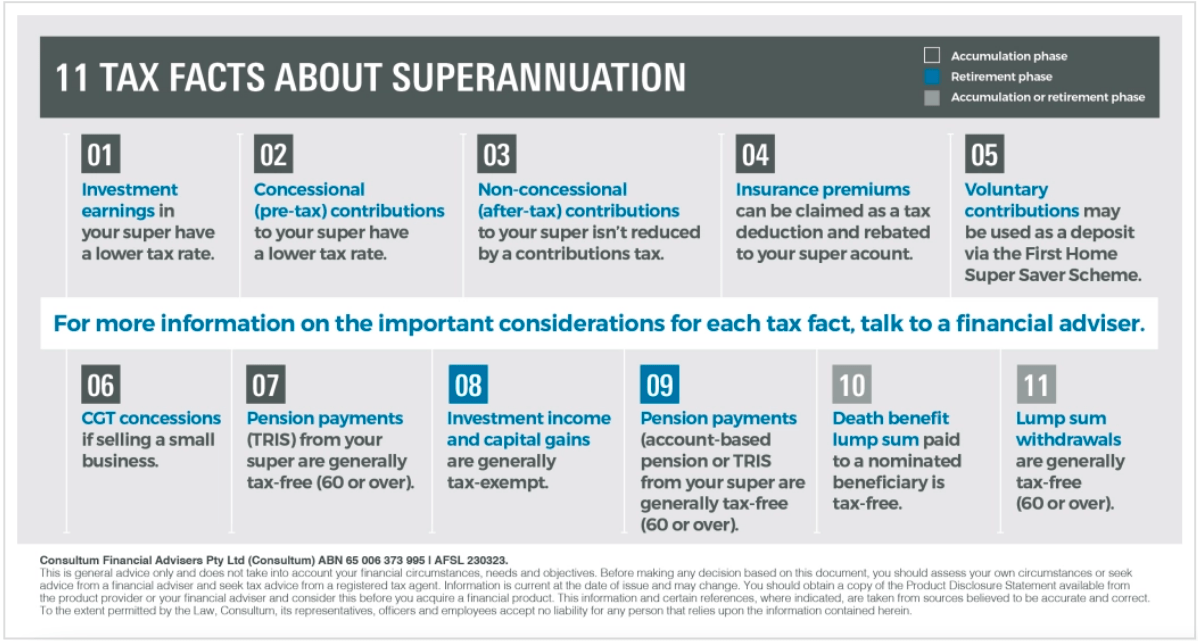

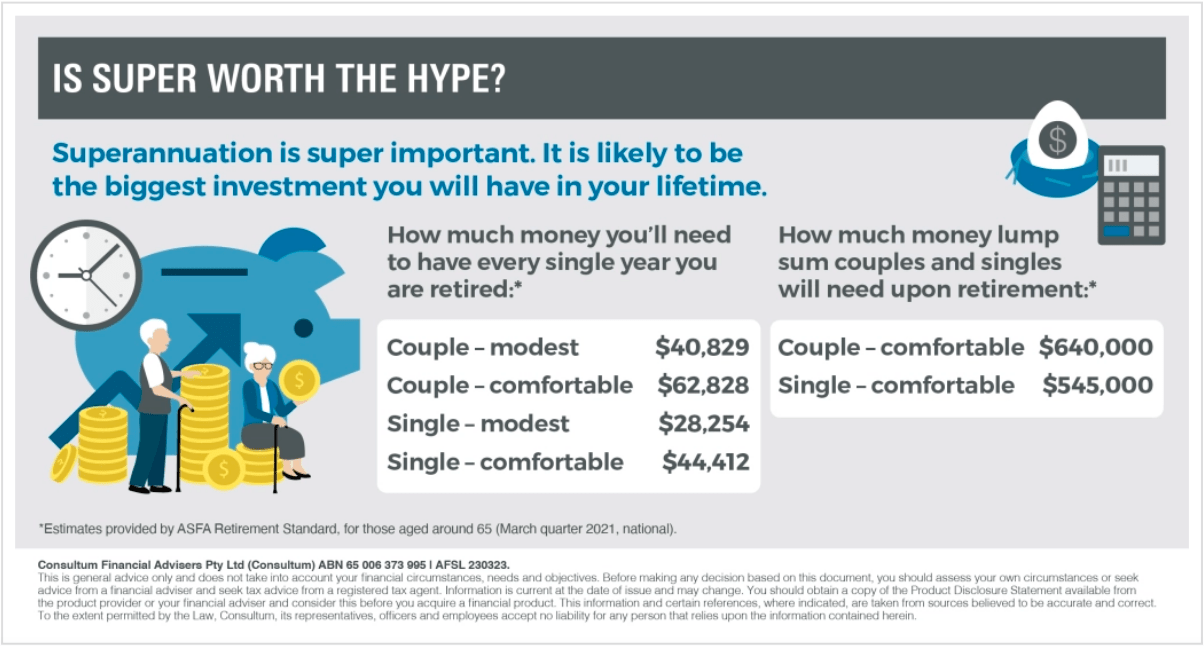

For those unaffected by Division 296, super remains an attractive option for retirement savings. Making additional contributions prior to EOFY presents an opportunity to maximise savings through various avenues such as concessional and non-concessional contributions, salary sacrifice arrangements, and downsizer contributions.

The draft Treasury Laws Amendment (Better Targeted Superannuation Concessions and Other Measures) Bill 2023, introduced to Parliament in 2023 is currently under scrutiny by the Senate Economics Legislation Committee, with a report expected next month. If passed and granted Royal Assent, Division 296 will come into effect from July 2025.

This forthcoming regulation represents a substantial change to superannuation rules, particularly impacting members with significant account balances. Given its complexity, seeking professional advice is crucial for informed decision-making concerning super and wealth creation strategies in the upcoming years.

CONTACT ALLAN HALL SUPERANNUATION