Tax and Superannuation Overview

The Federal Treasurer, Mr Josh Frydenberg, handed down the 2022–23 Federal Budget at 7:30pm (AEDT) on 29 March 2022.

In an economy emerging from the pandemic, the Treasurer has confirmed an unemployment rate of 4% and an expected budget deficit of $78 billion for 2022–23.

As international uncertainties add pressure to the cost of living, key measures provide cost of living relief in the form of an increased Low and Middle Income Tax Offset, a one-off $250 payment for welfare recipients and pensioners and a 6-month fuel excise relief.

Other measures seek to promote innovation, with expanded “patent box” tax concessions proposed, and provide tax incentives for small business to invest in the skills of their employees. A lower GDP uplift rate for PAYG and GST instalments has also been proposed to support cash flows of small and medium businesses.

To read our comprehensive Budget report outlining the changes to taxation and accounting, please click below:

The highlights are set out below:

Business

- Additional state and territory COVID-19 business support grant programs will be eligible for tax treatment as non-assessable non-exempt income until 30 June 2022.

- Small and medium businesses will be able to deduct an additional 20% of expenditure incurred on external training courses provided to their employees.

- Small and medium businesses will be able to deduct an additional 20% of eligible expenditure supporting digital adoption.

- The Boosting Apprenticeship Commencements wage subsidy will be extended by 3 months.

- Concessional tax treatment will apply from 1 July 2022 for primary producers selling Australian Carbon Credit Units and biodiversity certificates.

- Access to employee share schemes in unlisted companies will be expanded.

- The PAYG instalment system is set for a structural overhaul with a set GDP uplift of 2% to apply for the 2022–23 income year.

- Additional funding will be provided to further reform insolvency arrangements, including the insolvent trading “safe harbour”.

- Business registry fees will be streamlined over 3 years from 2023–24.

- Wholly owned Australian incorporated subsidiaries of the Future Fund Board of Guardians will be exempt from corporate income tax.

Increased deduction for small business external training expenditure

Small and medium businesses will be able to deduct an additional 20% of expenditure incurred on external training courses provided to their employees.

The additional deduction will apply for businesses with aggregated turnover of less than $50 million. The external training course must be delivered by an Australian entity and provided to employees in Australia or online. In-house or on-the-job training and expenditure for persons other than employees will be excluded.

The measure will apply for eligible expenditure incurred from 7:30pm (AEDT) on 29 March 2022 (Budget night) until 30 June 2024. Where eligible expenditure is incurred before 1 July 2022, the additional deduction will be claimed in the tax return for the following income year.

Increased deductions for digital adoption by small businesses

Small and medium businesses will be able to deduct an additional 20% of eligible expenditure supporting digital adoption.

The additional deduction will apply for businesses with aggregated turnover of less than $50 million. Eligible expenditure will include the cost of depreciating assets and business expenses supporting digital adoption, such as portable payment devices, cyber security systems or subscriptions to cloud-based services. An annual cap of $100,000 will apply to expenditure eligible for the additional deduction.

The measure will apply for eligible expenditure incurred from 7:30pm (AEDT) on 29 March 2022 (Budget night) until 30 June 2023. Where eligible expenditure is incurred before 1 July 2022, the additional deduction will be claimed in the tax return for the following income year.

Apprenticeship wage subsidy extended

The Boosting Apprenticeship Commencements wage subsidy will be extended to support businesses and Group Training Organisations that take on new apprentices and trainees. The subsidy will now be available to 30 June 2022. This measure will provide for an additional 35,000 apprentices and trainees. Eligible businesses will be reimbursed up to 50% of an apprentice or trainee’s wages of up to $7,000 per quarter for 12 months.

Individuals

- The low and middle income tax offset will be increased by $420 in the 2021–22 income year to ease the current cost of living pressures.

- A one-off payment of $250 will be made to individuals who are currently in receipt of Australian government social security payments, including pensions, to ease cost of living pressures.

- Additional funding will be provided over 5 years to support older Australians in the aged care sector with managing the impacts of the pandemic.

- Costs of taking a COVID-19 test to attend a place of work will be tax deductible for individuals and exempt from fringe benefits tax from 1 July 2021.

- A single Paid Parental Leave scheme of up to 20 weeks paid leave will replace the existing system of 2 separate payments.

- CPI indexed Medicare levy low-income threshold amounts for singles, families, and seniors and pensioners for the 2021–22 year announced.

- The number of guarantees under the Home Guarantee Scheme will be increased to 50,000 per year to assist homebuyers with lower deposits.

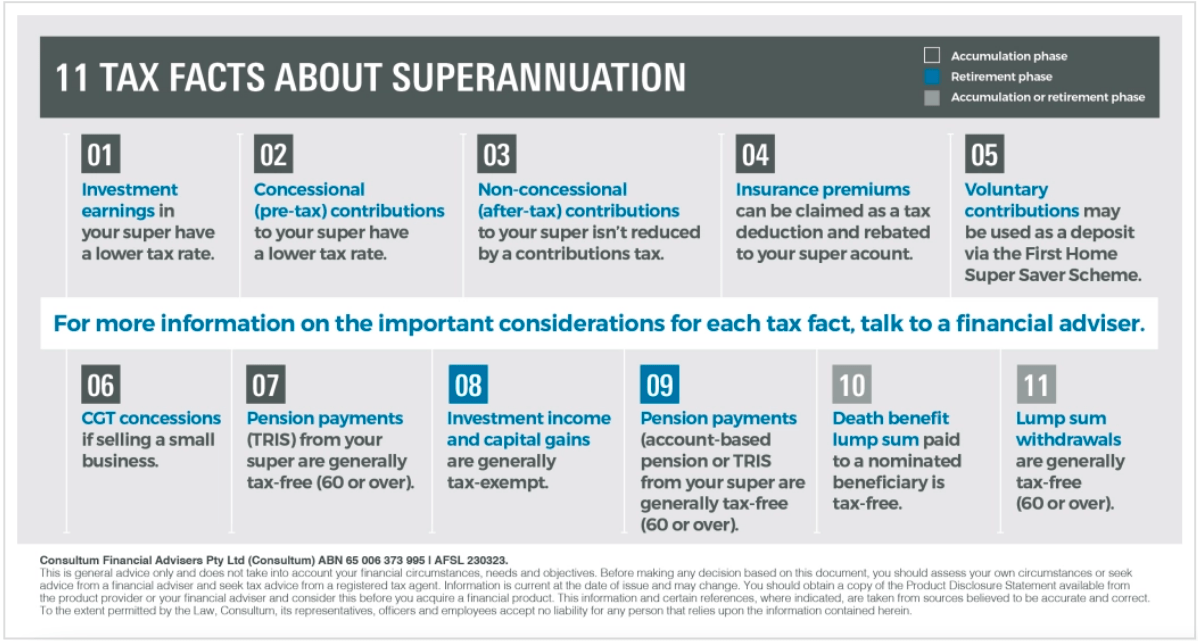

Superannuation

The 50% reduction of the superannuation minimum drawdown requirements for account-based pensions will be extended for an additional year.

Need help?

If you would like assistance to interpret these changes and how they may affect your individual circumstances or your business, please contact your Allan Hall Advisor on 02 9981 2300.

The full Budget papers are available at www.budget.gov.au and the Treasury ministers’ media releases are available at ministers.treasury.gov.au.

CONTACT ALLAN HALL