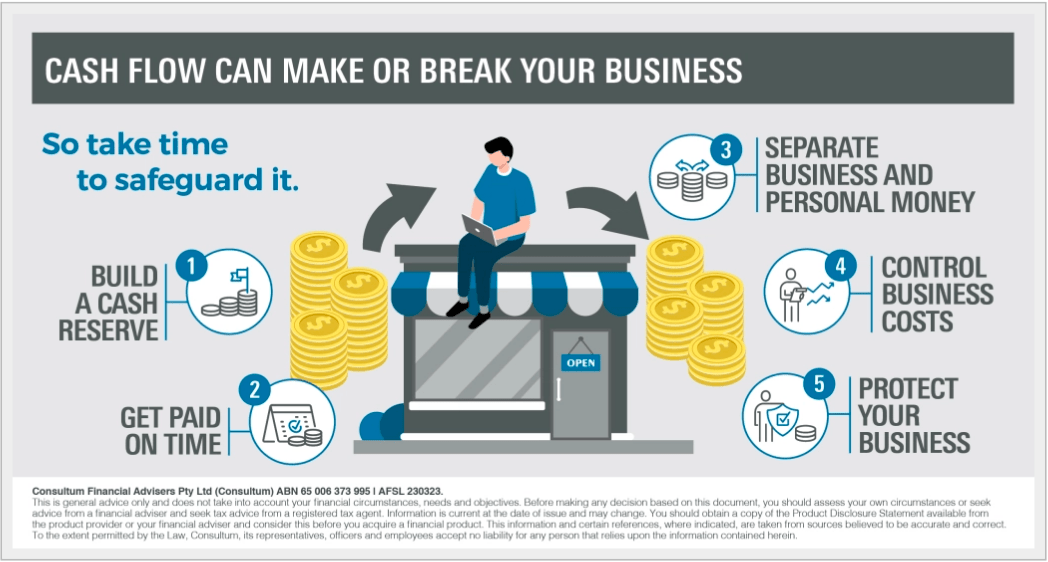

Cash flow can make or break your business, so take time to safeguard it

According to a survey by research firm East & Partners for lender Scottish Pacific, nearly 80 per cent of owners of small and medium enterprises said cash flow issues caused them the most sleepless nights.

So what might you do to improve your cash flow and sleep better at night? Here are five tips.

1. Build a cash reserve

Cash flow is the lifeblood of any business. To ensure that it makes, not breaks, your business, it’s important to build a robust cash reserve. This may help you meet your financial obligations in difficult times and allow you to take on opportunities to grow your business.

2. Separate business and personal money

By keeping business and personal expenses separate, you may better understand your business’s cash position. It may also ensure that you don’t use money meant for your business on personal expenses; for example, a holiday or your mortgage.

3. Get paid on time

If your business hasn’t been actively pursuing unpaid invoices, you may want to make it a practice – and have a strategy – to regularly chase up payment. Finding ways to encourage prompt payment, such as offering a discount to early payers, may help.

4. Control business costs

Controlling costs might help you to maintain a healthy cash flow. Experts suggest taking stock of your business expenses regularly to identify where you can cut costs without sacrificing growth. This may include reviewing your suppliers and negotiating better rates with them.

5. Protect your business

By taking out business expenses insurance and key person insurance, you may help ensure your business can meet its running costs if you or a key employee is too ill to work. Both insurance plans provide a monthly benefit if you or a key person in your business become incapacitated.

Work with a professional

Your professional financial adviser can tailor your insurance plans to your business’s cash flow protection needs, safeguarding what you’ve worked so hard to build.

General Advice Warning

The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.

Mark O’Connell, Robin Bell and Allan Hall Financial Planning Pty Ltd are Authorised Representatives of Consultum Financial Advisers Pty Ltd ABN 65 006 373 995 AFSL 230323.