Australia’s employment legislation is extensive, broad and can be incredibly complex.

And, if you don’t have a thorough understanding of your obligations to your employees, then your business could be at risk of underpayment of employee wages.

The underpayment of employee wages, or what the media has cleverly coined ‘Wage Theft’ can occur in any business. Recent media publications have shone a light on this issue, highlighting that every business, no matter the industry or business size, is at risk if wage obligations are not met.

It is critical you ensure your business is compliant with all legislation to avoid costly liabilities or negative publicity down the track, as a result of an employee claim or an ATO, Work Cover or Fair Work audit.

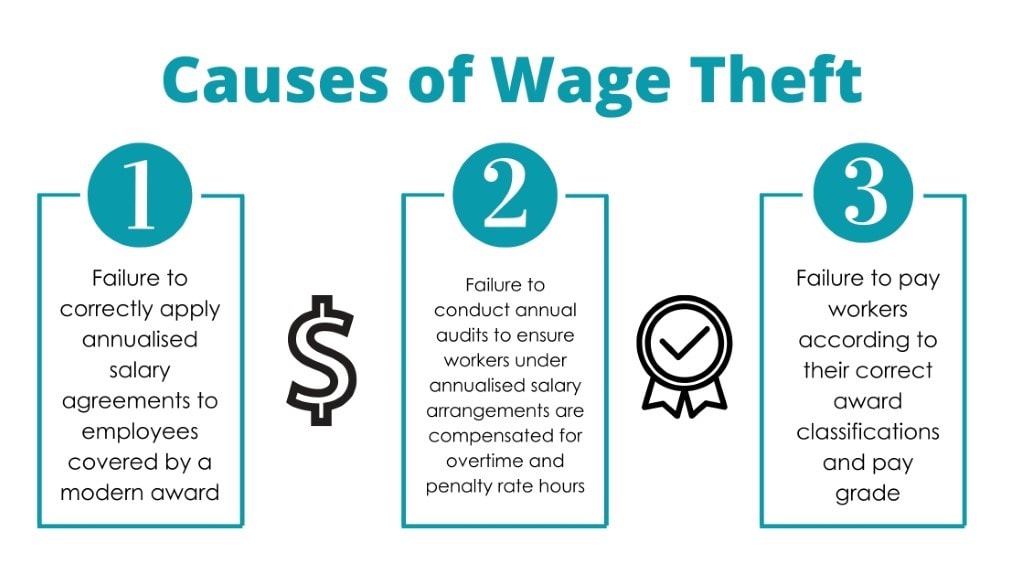

The Fair Work Ombudsman has found that the majority of wage underpayments are caused by employers failing to meet their obligations in the following areas:

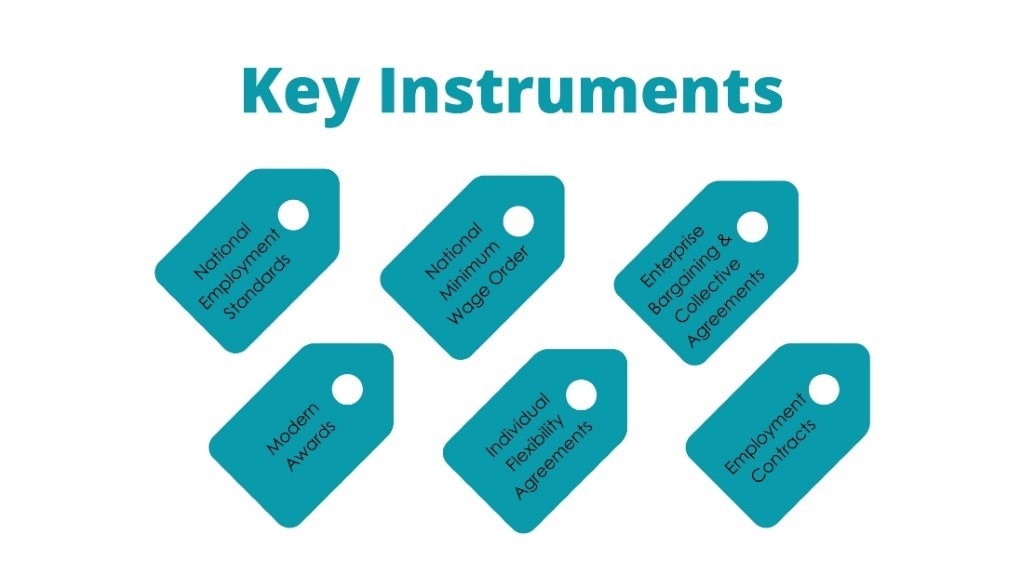

Employers must understand the key instruments their employees may be covered by as outlined below. These key instruments along with many more can have the ability to dictate what, when and how much an employee is paid.

Businesses who do not understand what industrial instrument covers their employees, or businesses without proper processes and systems in place, can often be unintentionally underpaying their staff, as rates of pay can vary greatly and are dependent on several factors.

How can we help at Allan Hall HR?

Australia’s industrial relations system can be difficult to navigate, especially without the help of HR professionals. This is where our team at Allan Hall HR come in and can assist you to navigate through this process efficiently and effectively.

Allan Hall HR offers compliance payroll audits for small, medium and large businesses, where we review your business operations against legislation requirements and recommend appropriate resolution of any non-compliant matters. We can also provide you with ongoing advice, assistance and tailored employment documentation to ensure you are compliant.

If you have any immediate questions regarding payment of your employees or any other HR matter, or are seeking support with a partial or full wage audit for your team, please feel free to contact our experienced HR Consultants today, call us on 1300 675 393 or read more here »

Australia’s employment legislation is extensive, broad and can be incredibly complex. And, if you don’t have a thorough understanding of your obligations to your employees, then the likely answer to our title question is YES…you are at risk of underpayment of employee wages!

The underpayment of employee wages, or what the media has cleverly coined ‘Wage Theft’ can occur in any business. Recent media publications have shone a light on this issue, highlighting that every business, no matter the industry or business size, is at risk if wage obligations are not met.

Sample Case:

George Calombaris is a very familiar name on this topic. It could even be argued that the popular MasterChef judge and celebrity is now just as renowned for his Wage Theft faux pas as he is for his culinary skills! The saga with his hospitality empire,

Australia’s employment legislation is extensive, broad and can be incredibly complex. And, if you don’t have a thorough understanding of your obligations to your employees, then the likely answer to our title question is YES…you are at risk of underpayment of employee wages!

The underpayment of employee wages, or what the media has cleverly coined ‘Wage Theft’ can occur in any business. Recent media publications have shone a light on this issue, highlighting that every business, no matter the industry or business size, is at risk if wage obligations are not met.

Sample Case:

George Calombaris is a very familiar name on this topic. It could even be argued that the popular MasterChef judge and celebrity is now just as renowned for his Wage Theft faux pas as he is for his culinary skills! The saga with his hospitality empire,