It’s important to explore options whilst you can make informed decisions

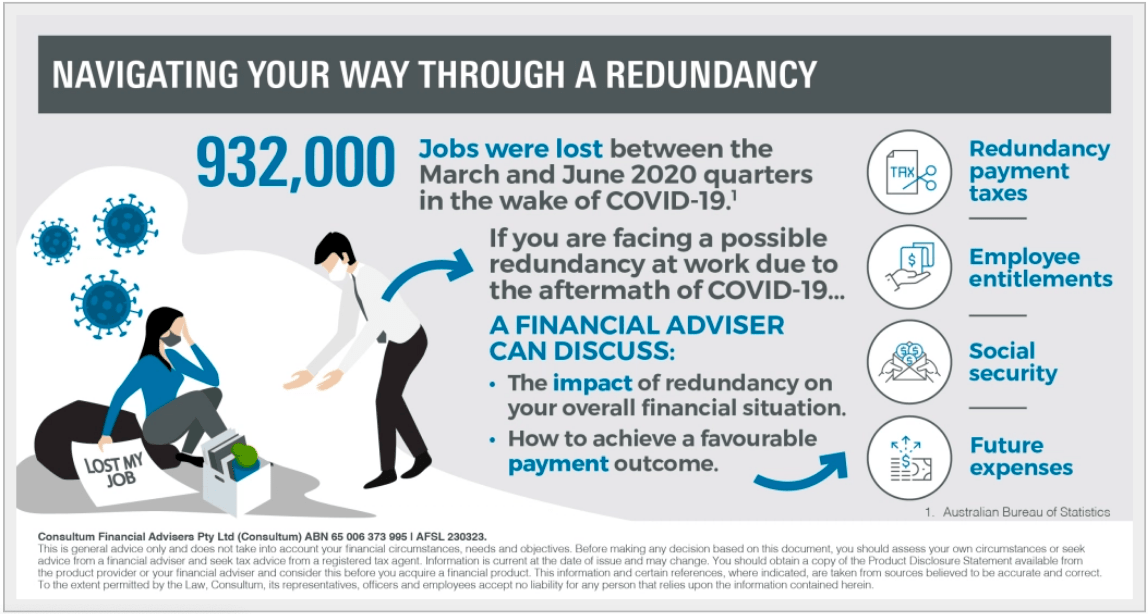

The last couple of years have been tough on a lot of people with the COVID pandemic throwing the world into chaos and taking a toll on our physical, mental, financial and emotional wellbeing.

If you have had a family member in aged care over the period of lockdowns and were not able to visit them or help care for them, you were probably even more grateful to the staff who turned up day in and day out to care for the residents. This highlights, even more, the importance of having options when it comes to aged care, and getting it right for you.

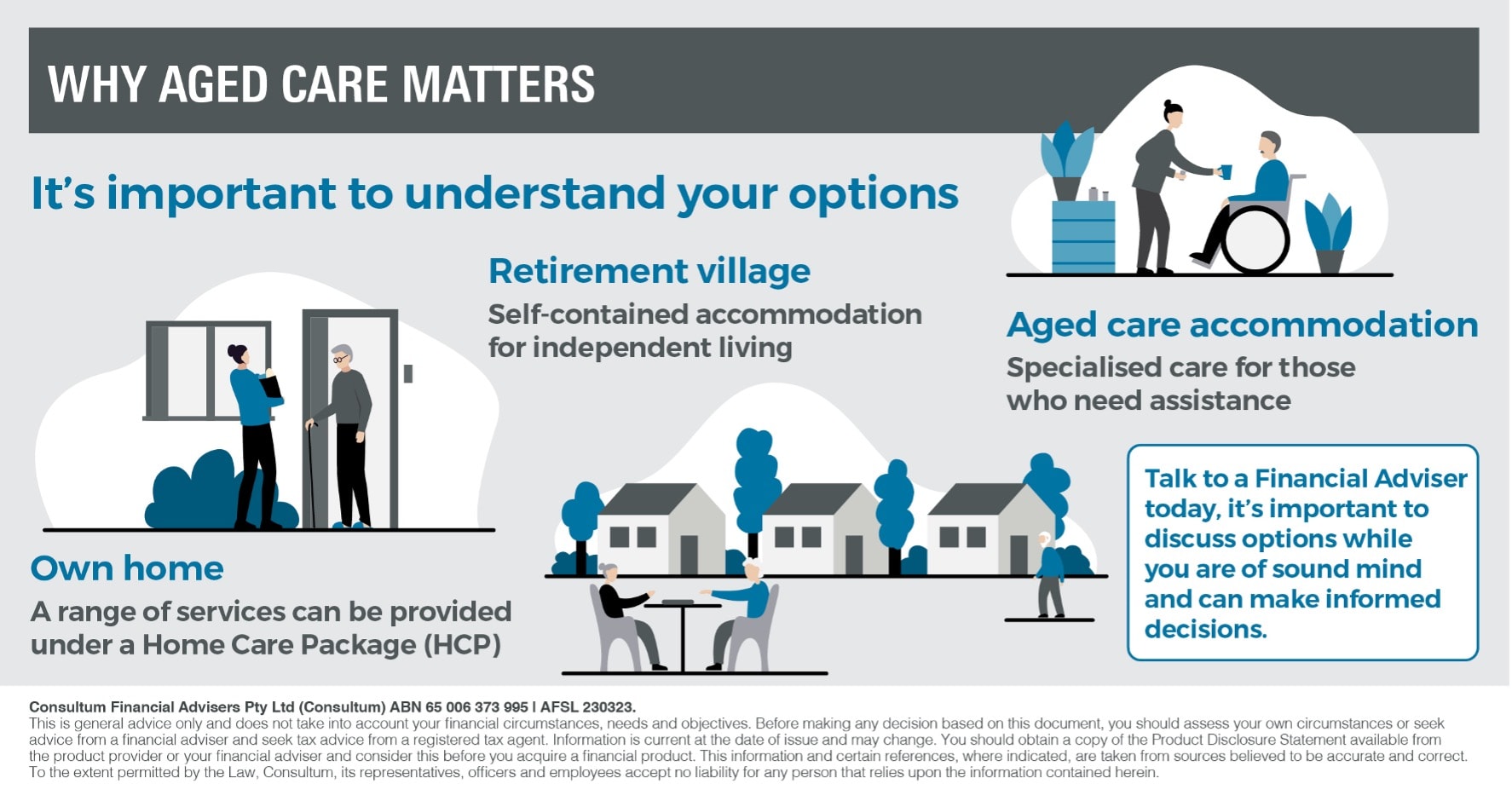

Accommodation options in retirement and aged care

Own home – if you choose to remain in your own home there are a range of services that can be provided under a Home Care Package (HCP). These may include personal care, clinical support and light home duties. A HCP can be hard to secure with greater demand than supply. As at 31 March 2021 there were 183,376 people who had accessed a HCP. This is a 20.7 per cent increase since 31 March 20201.

There is also a Commonwealth Home Support Program which is assessed by the regional assessment service to determine the type of in-home care needed.

Retirement village – a retirement village is a residential option offering a community lifestyle designed specifically for the needs and lifestyles of people over age 55. Most retirement villages offer self-contained accommodation for independent living. They may also provide services such as meals, cleaning and personal care for an additional fee.

Aged care accommodation – residential aged care is a purpose-built facility that offers specialised care for those who need assistance with their everyday living. The services provided may include:

- on-call staff for assistance

- meals

- basic accommodation services such as furnishings

- cleaning and general laundry

- bedding

- maintenance of buildings and grounds.

Additional services (such as hairdressing, outings or a cafe) are offered by some aged care residential facilities at an extra cost.

Accessing accommodation packages

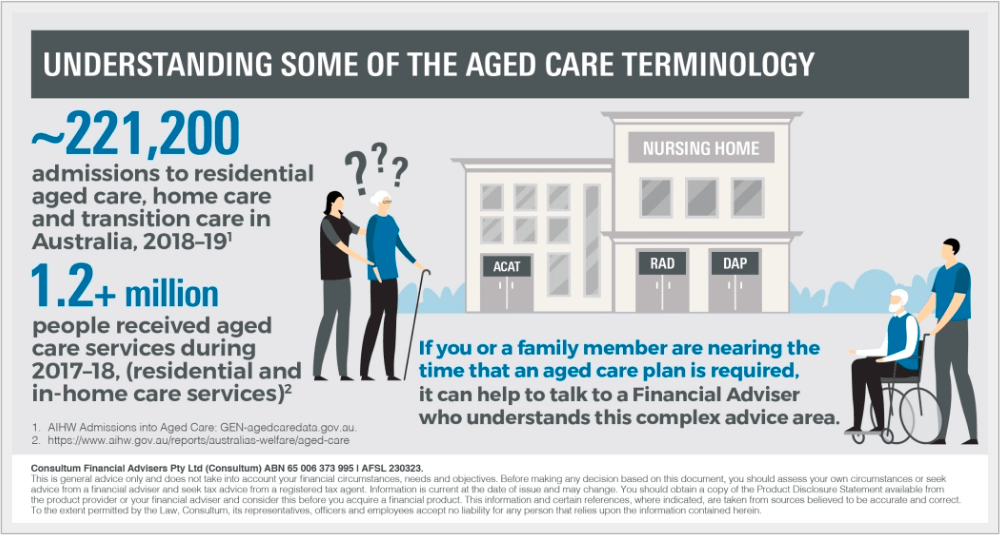

A conversation with an Aged Care Assessment Team (ACAT) is the key to accessing what packages are available to an individual to help determine if a home care package can be secured, or if entry to residential aged care accommodation is the more suitable option.

An ACAT assessment is done by doctors, nurses and social workers to assess the physical and mental needs of the individual.

Choosing an aged care facility

The decision on which aged care facility to choose is made by the prospective resident and their family. This decision may be largely based on accommodation cost and availability, but consideration should also be given to family circumstances, quality of the accommodation and facilities, reputation of the facility, closeness to family and friends and other personal and emotional factors.

It’s important to remember there are often long waiting lists for entry to many facilities, so it’s a matter of weighing up the urgency of entry and the availability of preferred facilities. The sooner you consider your aged care options and get onto a waitlist, the easier it is to make the transition. In saying this, you should also be prepared to move rapidly once a facility can accommodate you, as places tend to be assigned very quickly and if you take too long to decide, it may be offered to someone else.

Other considerations

This article barely scratches the surface of things you need to know when it comes to your aged care, or that of a family member or close friend. There is a lot to understand when it comes to costs, whether the family home needs to be sold or can be retained, impacts on the age pension for those in receipt of this social security payment and thought to ongoing income.

Talk to a Financial Adviser

With so much to know about this very important decision around how you, or someone you care about, will live out their final years, it’s important to get all the facts from a qualified Financial Adviser who understands the aged care system and can provide options and advice, giving consideration to your individual circumstances.

Make an appointment today to discuss aged care, it’s important to explore your options while you are of sound mind and can make informed decisions.

General Advice Warning

The information contained on this website is general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.

Mark O’Connell, Robin Bell and Allan Hall Financial Planning Pty Ltd are Authorised Representatives of Consultum Financial Advisers Pty Ltd ABN 65 006 373 995 AFSL 230323.

Source

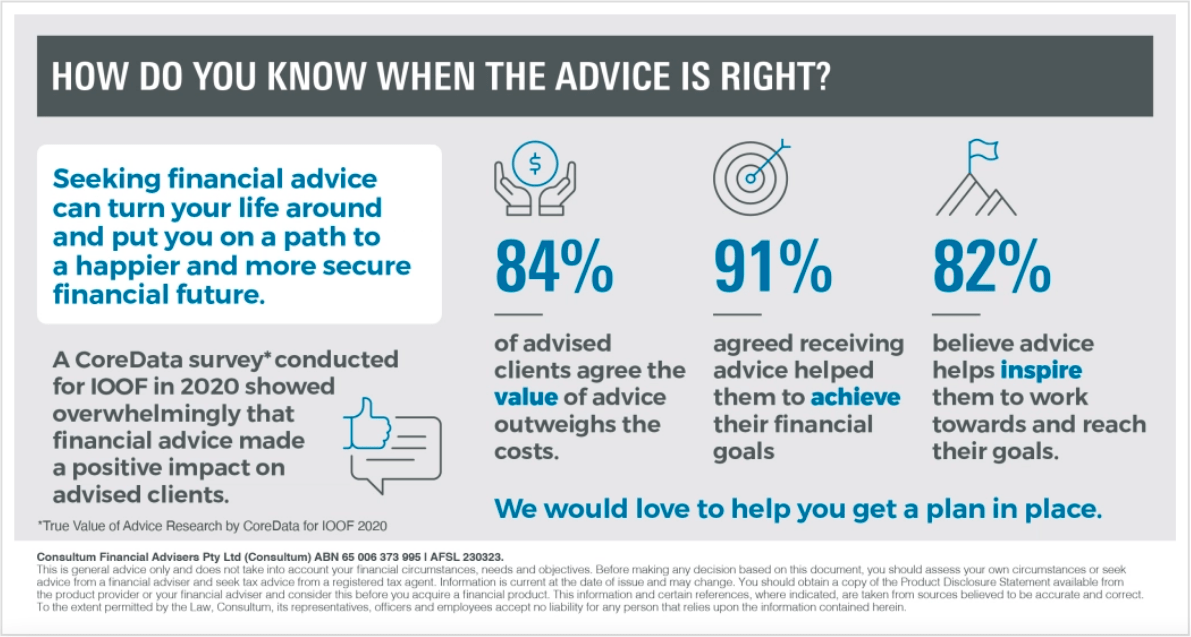

*IOOF Survey 2020: The True Value of Advice – A study of 12,643 Australians is an Authorised Representative of Lonsdale Financial Group, ABN 76 006 637 225, AFSL No 246934. This is general advice only and does not take into account your objectives, financial situation and needs. Before acting on this advice, you should consult a financial adviser.